Us: How much infrastructure do we need?

Crypto Industry: Yes!

As we speak, DefiLlama tracks roughly 277 blockchains. And this number will not be coming down anytime soon.

While this means multiple approaches, faster iteration, and diversity, it also creates one big problem: fragmentation. As a user, how are you supposed to pick the right chain and move assets between them, if necessary?

Polygon co-founder Sandeep Nailwal envisions a future with “hundreds of thousands of chains”, but he stresses that value on these myriad networks must be “connected and seamlessly movable” for Web3 to reach its potential.

In today’s reality, moving assets between chains is often hard. Users resort to bridges to hop from one chain to another, but these have a history of security issues and poor user experience.

Four of the five largest crypto exploits (totaling about $2.15 billion) have been bridge hacks, and users also face long wait times and clunky processes when bridging. This cross-chain fragmentation, many chains with siloed liquidity, makes it clear that better solutions are needed to enable a true “internet of value” across blockchains.

From Bridges to Intents: How Cross-Chain Swaps Are Evolving

Early on, moving assets across chains meant using conventional bridges. A bridge typically locks tokens on the source chain and mints a representation on the destination chain (or uses a burn-and-mint mechanism). While effective, these isolated bridges created duplicated liquidity (multiple wrapped versions of the same asset) and became lucrative targets for hackers (over USD 2 billion stolen via bridge exploits since 2020).

They also forced users to perform multiple steps – bridging, then swapping – for something as simple as exchanging Token A on Chain X for Token B on Chain Y.

To streamline the experience, bridge aggregators emerged. Platforms like Jumper (built by LI.FI) and LI.FI’s SDK aggregates many bridges and DEXs, finding the best path for a user’s transfer. Instead of manually checking multiple bridges, a user can enter their desired swap once and let the aggregator route it optimally. For example, Jumper enables seamless swaps across 25 blockchains by tapping into an array of DeFi liquidity sources. This aggregation improves success rates and pricing.

It’s been popular – LI.FI alone has processed over $7 billion in cross-chain volume (nearly 9 million transactions) as of 2023, serving dozens of DApps and wallets.

Bridge aggregators significantly improved UX and access, but under the hood, they still rely on those base bridges and don’t fully abstract away the cross-chain process. Users might still worry about which bridge is used or wait for intermediate transactions to finalize.

The next leap in the evolution is the move toward intent-based models for cross-chain swaps. Interestingly, some aggregators and DEXs are now pivoting to this approach. LI.FI’s API has been updated to support “DEX aggregators, bridges, and intent-systems” in one unified interface.

Likewise, 1inch (known for same-chain DEX aggregation) introduced its Fusion+ upgrade to turn cross-chain swaps into an intent-based system, favoring bridgeless atomic swaps handled by professional solvers over traditional bridges.

Even Uniswap – the largest decentralized exchange – rolled out UniswapX in mid-2023, an intent-powered auction system where off-chain “fillers” find the best price for users’ trades across any available liquidity source. In short, the industry is coalescing around the idea that users should be able to specify simply what they want to do and let the system figure out how to do it across chains.

How Intent-Based Swaps Work (Step by Step)

In an intent-based architecture, a user no longer crafts a step-by-step transaction (bridge X to Y, then swap, etc.). Instead, the user defines their intent – the desired end state – and a network of executors handles the rest. As a recent report put it, a blockchain transaction usually says how to act, whereas an intent specifies what outcome the user wants. In practice, this means the user broadcasts a message like: “Swap 5 ETH on Ethereum for USDT on BNB Chain (min. 5,500 USDT)”, and they sign this intent. They do not have to specify the route or intermediate steps.

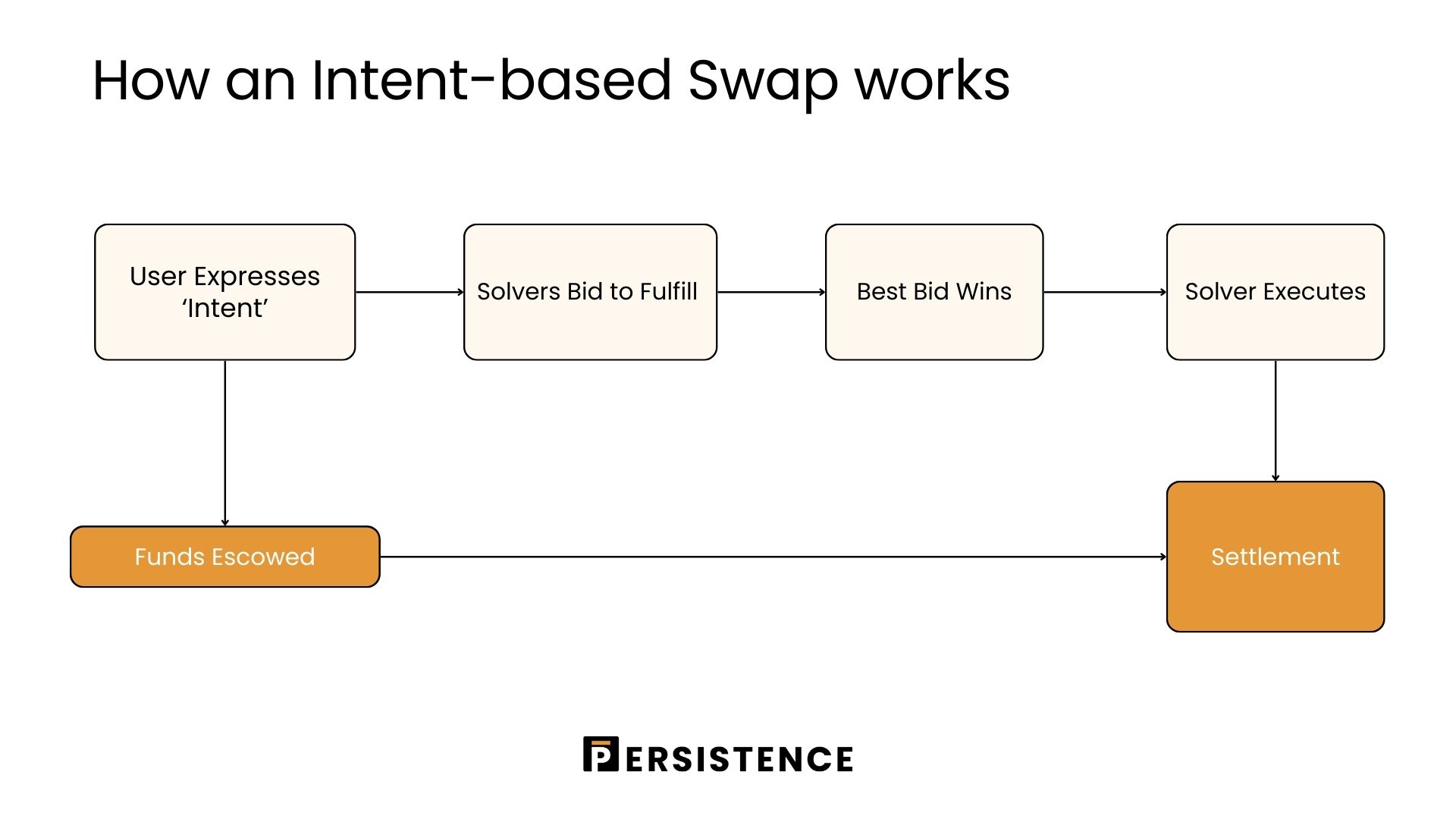

Here’s how an intent-based cross-chain swap typically works in steps:

- User Expresses Intent: The user signs an off-chain message describing what they want (for example, swapping asset X on Chain A for asset Y on Chain B). This request is submitted to an intent protocol’s network.

- Funds Escrow: The user’s assets (to send) are locked in a smart contract on the source chain as an escrow guarantee. This ensures the intent can be trustlessly fulfilled.

- Solvers Bid to Fulfill: Specialized third parties called solvers (also known as fillers or executors) compete to fulfill the user’s intent. Solvers are like the “market makers” of this system – they might be professional liquidity providers, arbitrageurs, or even other protocols. They calculate an optimal way to get the user the desired asset on the destination chain, and they bid to do the job for a certain fee or under certain conditions.

- Best Bid Wins (Auction): The system selects a winning solver via an auction mechanism. Different protocols use different auction styles – some run a quick competition where any solver can attempt to fill (first to do so wins), others collect off-chain quotes (RFQ) and let the user choose, and some (like 1inch Fusion, UniswapX) run a Dutch auction that starts at a price ceiling and ticks downward until a solver accepts the trade. The goal is to ensure the user gets the best possible rate through open competition.

- Solver Executes Swap: The winning solver fronts the destination asset out of their liquidity to the user. In other words, the solver immediately sends the requested output (e.g. USDT on BNB Chain) to the user, so the user achieves their desired result without waiting for cross-chain finality. This is possible because the solver is confident they will be paid back from the escrow.

- Settlement: Once the solver proves that the intent was fulfilled on the destination chain (often via an oracle or messaging system), the escrowed funds on the source chain are released. The protocol sends the user’s originally locked asset (ETH on Ethereum in our example) to the solver as reimbursement. The intent is now completed end-to-end.

Throughout this process, the user only had to sign one intent and wait briefly – the heavy lifting of swapping and bridging was handled by solvers competing behind the scenes. As an analogy, it’s like telling a travel agent, “I want to visit Paris on these dates”, and letting them handle flights and hotels, rather than booking each leg yourself.

Why Intent-Based Swaps Are a Game-Changer

Intent-based swaps bring several advantages over conventional bridging techniques:

- Seamless User Experience: By abstracting away the multi-step process, intents make cross-chain activity feel like a single transaction. Users don’t need to juggle multiple apps or tokens to bridge and then swap; they simply specify their goal and get the result. This streamlined UX lowers the barrier to using multiple chains.

- Unified Liquidity & Best Prices: Because solvers can draw on many sources (DEXs, CEXs, other bridges) to fulfill an intent, the user taps into a unified liquidity pool that spans chains. Solvers essentially aggregate liquidity on the user’s behalf. Combined with the auction mechanism, this means users are more likely to get the best exchange rate with minimal slippage. Competition among solvers drives fees down and efficiency up.

- Speed and Convenience: Intent protocols are designed for quick execution. Solvers fronting the funds means the user doesn’t wait for long bridge finality – you get your destination tokens almost immediately in many cases. Transactions are completed within a predefined timeframe, and fees are often known upfront.

- Security and Risk Reduction: Intent-based swaps can be more secure than ad-hoc bridging. The user is not holding IOU tokens or relying on a centralized custodian; instead, atomic swap techniques and escrow ensure that either the swap completes or the user can reclaim funds.

- Composability: Intents open the door to more complex cross-chain interactions (like multi-step trades, cross-chain yield moves, etc.) handled by solvers who are specialists. This could unlock new DeFi strategies that span multiple ecosystems without burdening the user with coordination.

There’s no giant honeypot of liquidity sitting on a bridge to be hacked – liquidity comes from solvers only when needed. Moreover, solvers take on the finality and MEV risk on behalf of the user. For instance, if a cross-chain transfer fails or a price moves, the solver generally bears that risk (they only get paid when the swap succeeds). Users are protected from many complexities like reorgs or frontrunning on the cross-chain path. Additionally, because the user’s intent doesn’t broadcast an exact route, it’s harder for MEV bots to target the transaction with sandwich attacks. All of this means a safer and smoother ride for the end-user.

About Persistence One

Persistence One is building the BTCFi Liquidity Hub, enabling fast, near zero-slippage swaps for BTC, BTC-variants, and LSTs on Persistence DEX.

BTCFi’s rapid growth has created multiple BTC-related assets, making fragmentation a big challenge. Persistence One will provide a single liquidity hub, simplifying value transfer across the Bitcoin ecosystem.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]