Bitcoin: The Immortal Asset

There’s no real debate. Bitcoin is here to stay. Yet, every cycle, the sceptics reemerge with their doomsday prophecies, convinced that this time, Bitcoin will finally collapse. But it never does. Why? Because Bitcoin isn’t just an asset; it’s a movement, a belief system, and a force of nature that refuses to be stopped.

Let’s talk about why Bitcoin can never die.

1. Network Effects: The Self-Fulfilling Machine

Money is a network, and Bitcoin is the strongest one. Every new participant strengthens it, and at this point, reversing its momentum is impossible. Miners, developers, institutions, nation-states—everyone has skin in the game. The Lindy effect is in full force: the longer Bitcoin exists, the longer it’s expected to exist. The genie is out of the bottle, and no amount of regulation, media attacks, or energy FUD can put it back in.

These numbers might put this into perspective. Please note that just in Week 4 of 2025, we have a total inflow of ~$1.7B.

Source: 21shares.com

2. Irrational Exuberance: The Cult of the Orange Coin

Bitcoin doesn’t just attract rational investors; it breeds fanatics. Take Didi Taihuttu—the guy who sold everything to go all-in on BTC. Or the laser-eyed maximalists who refuse to hold a single sat on an exchange. Every financial system needs believers, and Bitcoin has the most hardcore ones. Unlike traditional markets, where people panic and exit, Bitcoiners double down in downturns. These people aren’t here for short-term gains—they’re here for ideological and generational wealth.

One of the classic examples of this behaviour in action is Michael Saylor’s strategy. Checkout his purchases at each step of Bitcoin’s journey. Uptrend or Downtrend, the man is buying.

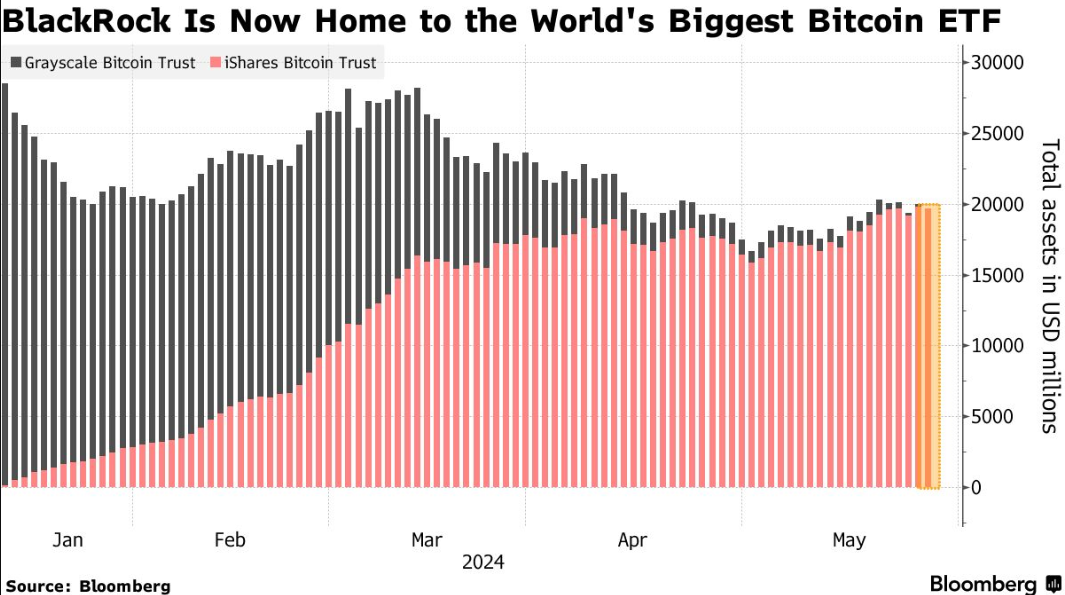

3. Smart Money Doesn’t Bet Against BTC

The smartest investors don’t short Bitcoin; they accumulate. Institutions like BlackRock don’t launch ETFs for assets they think will die. The long-term trend? Sovereign accumulation. ETFs, nation-state adoption, and even pension funds dipping in. It’s no longer just a “cypherpunk fantasy”—Bitcoin is sitting at the same table as gold and treasuries.

4. The Ultimate Exit Plan

Bitcoin is the hedge against everything. Inflation? Bitcoin. Banking crisis? Bitcoin. Government overreach? Bitcoin. When traditional systems falter, BTC is the ultimate insurance policy. Even if a doomsday scenario played out and governments tried to kill it, Bitcoin would just go underground—running on mesh networks, satellite nodes, and cold storage in every corner of the globe. You can’t stop an idea whose time has come.

The Next Frontier: Bitcoin + DeFi = BTCfi

Bitcoin is inevitable, but now, it’s evolving. The next step? BTCfi. No longer just a store of value, Bitcoin is creeping into lending, liquidity pools, and yield strategies—without compromising its core principles. The strongest asset in history is about to become the foundation of an entirely new financial system. Are you paying attention?

Bitcoin isn’t dying. It’s just getting started. With Persistence leading the charge in Interoperability, BTCfi is becoming a reality, bringing institutional-grade financial applications to Bitcoin and making truly decentralized finance possible.

About Persistence One

Persistence One is building the BTCFi Liquidity Hub, enabling fast, near zero-slippage swaps for XPRT, BTC-variants, and BTCfi tokens on Persistence DEX.

BTCFi’s rapid growth has created multiple BTC-related assets, making fragmentation a big challenge. Persistence One will provide a single liquidity hub, simplifying value transfer across the Bitcoin ecosystem.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]