At the heart of the Persistence ecosystem lies Persistence DEX, a decentralised exchange purpose-built to allow the swapping of liquid-staked assets and bring interoperability to the BTCfi world.

With the highly anticipated V2 upgrade on the horizon, set to introduce interoperability to the bubbling BTCfi sector, it’s the perfect time to explore the features and functionality of Persistence DEX (V1).

Persistence DEX is designed to become the central hub for Bitcoin variants and Liquid Staked Tokens (LSTs), offering seamless interoperability and unrivalled liquidity in the BTCfi ecosystem.

Here’s what you need to know about how it works and why it stands out.

Facilitating Trading for Liquid Staked Assets

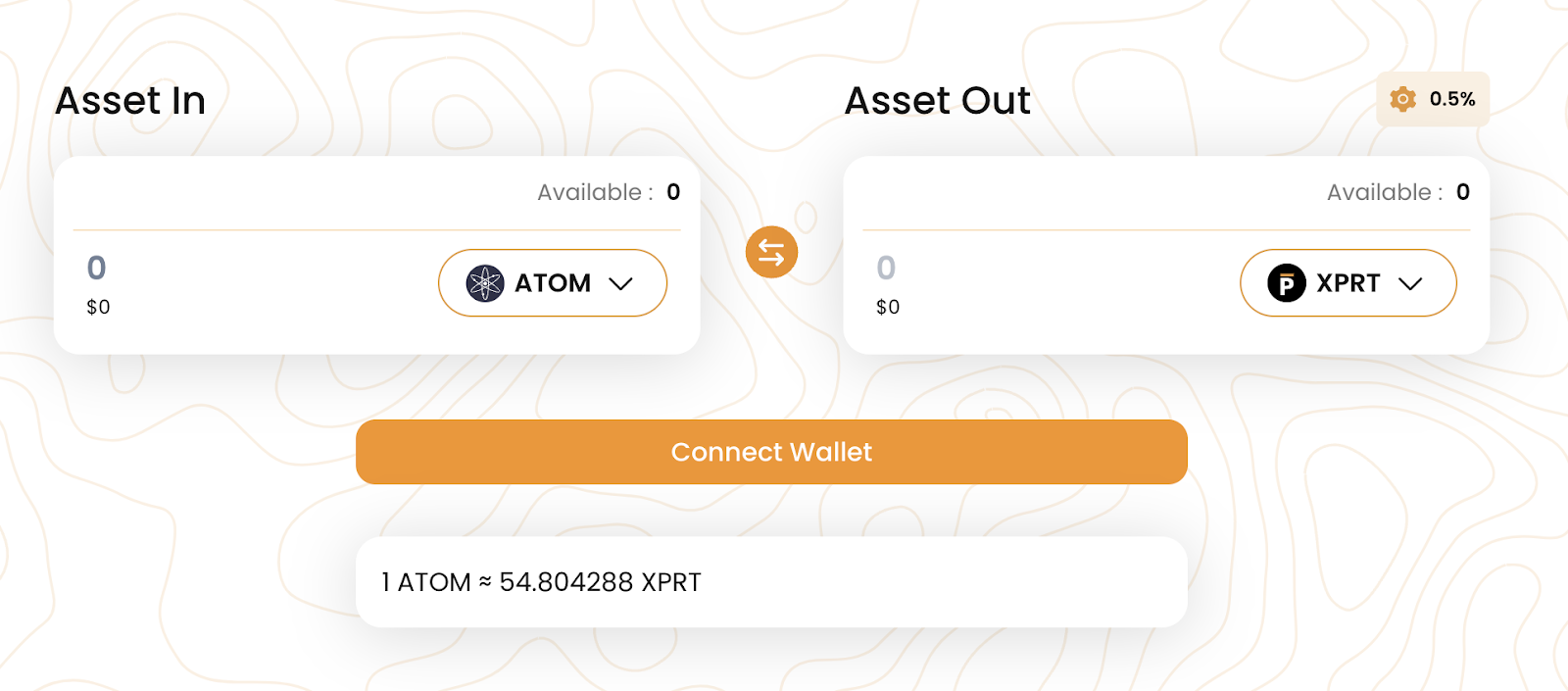

At its core, Persistence DEX is built to enable smooth trading of Liquid Staked Assets (LSTs). Whether you’re trading Cosmos-based tokens, stablecoins, or Bitcoin variants (coming in V2), the platform easily connects users to high-profile assets.

Supported Assets on Persistence DEX:

- XPRT

- stkXPRT

- WBTC

- ATOM

- Stablecoin swaps

With a user-friendly interface, Persistence DEX makes swapping assets as simple as connecting your wallet and clicking a few buttons. Various liquidity pools back these trades, enabling users to add liquidity and earn rewards via trading fees.

Understanding the Different Pools on Persistence DEX

One way Persistence DEX differentiates itself is through its innovative Automated Market Maker (AMM) pools. Designed for efficiency and flexibility, these pool types are inspired by leading models like Curve and Balancer but take things a step further.

Persistence DEX AMM Pool Types:

- Stableswap Invariant Pool

Incorporates constant product and constant sum functions for low-slippage trades when the pool is balanced, ensuring liquidity availability in imbalanced states.

- Ideal for liquid-staked tokens correlated with their base assets (e.g., stkXPRT with XPRT).

- Enables stakers to instantly redeem their assets by swapping liquid-staked variants for underlying tokens.

- Weighted Pool:

Customizable weight ratios between assets allow for diverse portfolios. Inspired by Balancer, it caters to traders and LPs looking for flexibility and variety.

- Metastable Pool:

Enhances trading efficiency for assets with varying price correlations, further enhancing the practicality of the DEX.

These proprietary pools make Persistence DEX a haven for seamless and dynamic asset trading, optimized for DeFi power users and liquidity providers.

Additional Features That Set Persistence DEX Apart

Persistence DEX goes beyond trading by empowering Liquidity Providers (LPs) with unique tools like Instant LP Unbonding, which ensures unrivalled flexibility and control.

Instant LP Unbonding Explained:

This innovative feature allows LPs to access their liquidity immediately – significantly reducing the standard 7-day withdrawal period. Here’s why it’s game-changing:

- Immediate Access: Perfect for emergencies or market volatility, enabling users to unlock assets instantly.

- Risk Mitigation: A fee structure discourages disruptive withdrawals during normal market conditions, ensuring liquidity stability for all users.

- Gradual Fee Reduction: If liquidity is already unbonding, fees decrease as the remaining unbonding days diminish.

This blend of user flexibility and system stability strengthens Persistence DEX’s position as a leader in decentralized liquidity management for LPs.

The Move Toward Interoperability in the BTCfi World

While V1 of Persistence DEX showcases powerful trading and liquidity solutions, V2 promises to revolutionize Bitcoin-native DeFi by addressing one of Bitcoin finance’s biggest challenges – cross-chain interoperability.

Currently, the BTCfi ecosystem suffers from inefficiencies. Moving Bitcoin variants across dozens of ecosystems and sidechains often requires time-consuming and expensive bridges or centralized exchanges. Persistence One’s V2 upgrade for Persistence DEX solves this problem with an interop-first approach.

Why Interoperability Matters

Interoperability in the BTCfi world enables:

- Faster transactions between Bitcoin variants.

- Reduced friction across blockchains.

- Increased user adoption.

In summary, Persistence DEX aims to become a Bitcoin-focused cross-chain swapping solution designed to connect fragmented BTC ecosystems. The solution leverages an intents-based model that focuses on what users want from their swaps, leaving the how-to Solvers—experts who handle the back-end routes through unified liquidity across the DeFi landscape.

The result? Fast, zero-slippage swaps between BTC variants with minimal effort on the part of users.

Pioneering the Future of BTCfi with Persistence

Persistence DEX is more than just a standard DEX. It is the foundation of the emerging BTCfi ecosystem that is set to reach its potential with interoperability setting the rail to help it happen. By bridging fragmented Bitcoin L2s and ecosystems in V2, it is poised to accelerate BTCfi’s adoption to new heights.

With V2 on the horizon, this is the perfect opportunity to learn about Persistence DEX and its inner workings before introducing interoperability.

About Persistence One

Persistence One is building the BTCFi Liquidity Hub, enabling fast, near zero-slippage swaps for XPRT, BTC-variants, and BTCfi tokens on Persistence DEX.

BTCFi’s rapid growth has created multiple BTC-related assets, making fragmentation a big challenge. Persistence One will provide a single liquidity hub, simplifying value transfer across the Bitcoin ecosystem.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]