Despite the recent market turbulence, Bitcoin is still up by an impressive 40% since the 2024 opening price.

While Bitcoin looks primed for further growth with increased institutional adoption, the price hike doesn’t give a complete picture of what’s really going on behind the scenes or explain why the BTC landscape is changing.

A lot is happening under the hood, and the BTC landscape is completely different from what it was at the start of the year (or even just six months ago).

Let’s take a look at the BTC landscape and analyze how it changed over the past six months.

Bitcoin Dominance Keeps Rising

One key factor distinguishing the 2024 bull run from others is the amount of capital flowing into Bitcoin, which has caused its dominance to rise substantially relative to the rest of the industry.

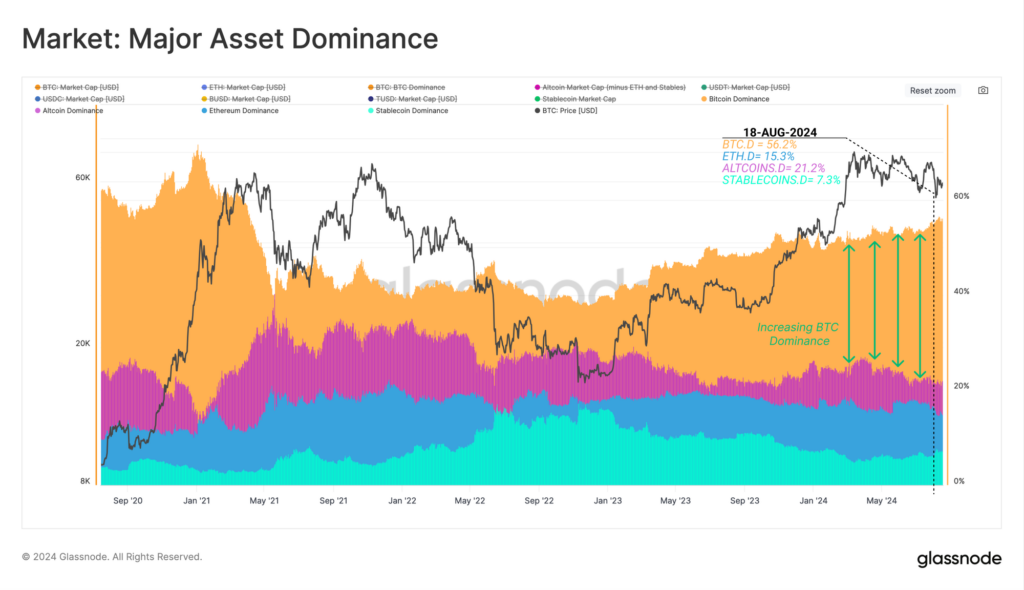

The chart below shows that BTC Dominance is up substantially since the start of the year and continues to trend upward;

In fact, since the November 2022 lows, Bitcoin dominance has increased from as low as 38.7% to the current 56% level. At the same time, Ethereum, Stablecoin, and Altcoin dominance has shrunk, demonstrating that capital is flowing into Bitcoin rather than the rest of the industry;

So, why is the majority of capital flowing into Bitcoin?

The answer lies in institutional adoption and the rise of Bitcoin DeFi.

Bitcoin ETF Brings Institutional Adoption to Crypto

The SEC’s approval of eleven ETFs in January 2024 was one of the most significant driving forces in changing the BTC landscape in 2024.

The approval of the ETFs opened the door to a compliant route for institutional adoption, allowing hedge funds, governments, and corporations to easily invest in the number-one-ranked digital asset.

According to Quinten Francois, co-founder of WeRate, around 60% of the largest US hedge funds have now acquired Bitcoin exposure:

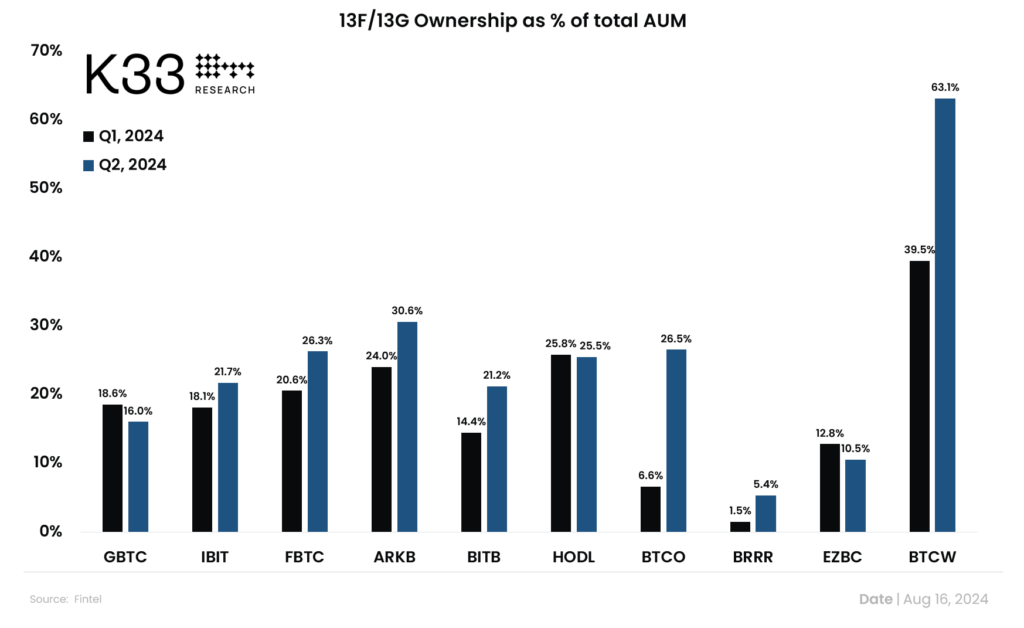

Further data from K33 Research reported that 262 new firms held investments in U.S. spot ETFs in Q2 2024, bringing the number up to 1,199 professional firms invested in the Bitcoin ETFS.

The dramatic increase in the number of professional firms buying into BTC through compliant vehicles suggests growing institutional confidence in digital assets:

As a result of the increased adoption, the Bitcoin whales are also starting to load up on their holdings – especially when prices dip.

According to data from Santiment, the number of whales that hold between 100-1,000 BTC have accumulated almost 95,000 more BTC in the last six weeks during the heavy bearish shakeout:

30,000 of the BTC accumulated were purchased during the early August 2024 market crash:

So, What’s Going On?

While the ETFs are bringing institutional adoption, there’s also a new revolution happening on-chain with the BTCfi ecosystem. The Bitcoin DeFi sector has seen somewhat of a revival since the introduction of Ordinals and Inscriptions in 2023, and it’s bringing a wave of innovation to Bitcoin.

BTCfi is a movement that brings DeFi applications to the Bitcoin blockchain. It brings Ethereum-like applications to Bitcoin, allowing them to leverage the blockchain’s mammoth security.

The best part about the BTCfi movement is that it’s based on “innovation without permission.” It allows builders to utilize the Bitcoin codebase to innovate without having to hard fork the network, giving rise to what’s being dubbed “Bitcoin Season 2.”

BTCfi has a big role in the growth of Bitcoin’s on-chain metrics. For example, Bitcoin’s total value locked (TVL) has grown tremendously in 2024 and continues to show resilience even with the latest price corrections.

According to DeFiLlama, there is approximately $528M locked on the Bitcoin mainchain itself (excluding sidechains):

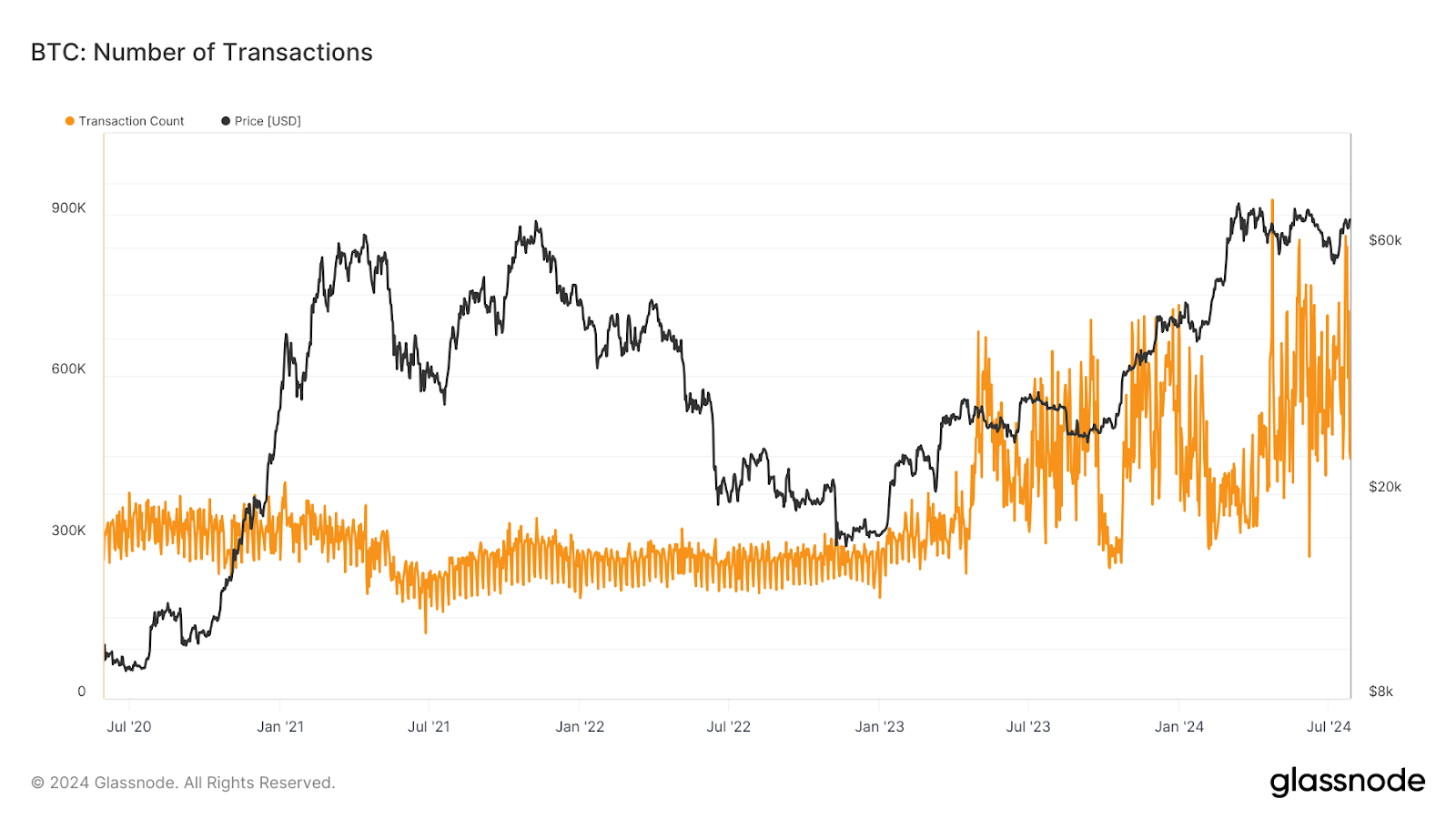

The introduction of BTCfi applications has led to a surge in the total number of transactions on the Bitcoin blockchain. The following chart illustrates the number of BTC transactions over the past three years, with a noticeable uptrend following the introduction of Ordinals in January 2023:

This rise can be largely attributed to the emergence of BTCfi, which opened up a plethora of opportunities to bring DeFi applications to the Bitcoin blockchain, sparking excitement about the potential of Bitcoin DeFi.

Builders on Bitcoin argue that the BTCfi industry has the potential to take BTC’s value proposition beyond a store of value into an asset class that can generate yields for its holders.

As a result of the innovation, a number of sidechains and Layer-2 platforms have emerged on the Bitcoin blockchain, all with unique angles to improve Bitcoin’s scalability and programmability.

The TVL on these chains is growing significantly, with data showcasing that the top Bitcoin Layer 2s holding a cumulative of almost $3.7 billion in TVL:

Reducing BTCfi Fragmentation with Interoperability

With the number of side chains and Layer-2s rising, one major hurdle remains before BTCfi can reach its full potential: fragmentation.

There are now more than 50+ BTCfi applications on the Bitcoin blockchain, with many bringing their own variation of BTC. The problem is that most of these variants aren’t interoperable and cannot be seamlessly swapped between one another.

This is where Persistence steps in with its cross-chain interoperability solution.

We’re on a mission to tie the BTCfi ecosystem together by creating the major venue that moves BTC and its variants around easily.

Our solution will bring fast, zero-slippage cross-chain swaps for Bitcoin Layer 2 assets using an intents-based solution.

With BTC dominance rising and BTCFi proliferating, the Persistence One solution aims to help the ecosystem through interoperability.

About Persistence One

Persistence One is building a Bitcoin interoperability solution to enable cross-chain BTC swaps across Bitcoin Layer 2s.

The rapid rollout of Bitcoin L2s and side chains has led to fragmentation, hurting BTCfi scalability. Using the power of intents, Persistence One will enable users to move assets across Bitcoin Layer 2s more efficiently than traditional bridging, offering fast, secure, zero-slippage cross-chain swaps.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]