Staking rewards (staking APR) in the Persistence One ecosystem is directly tied to inflation – ‘how many new XPRT tokens are minted each year’. Recently, inflation parameters were changed through governance, which will impact staking APR levels for stakers.

Previously, Proposal #23 reduced the minimum inflation from 25% to 12.5% and the maximum inflation from 45% to 25%. This change was necessary because of a slower-than-expected block time (~6s instead of 5s).

In June 2024, Proposal #109 further halved the inflation range to 6.25%–12.5% as part of a broader effort to slow down supply growth. On March 12, 2025 (Block 21,038,400), inflation was automatically reduced again to 3.125%–6.25% as scheduled.

However, following this reduction, staking rewards dropped, potentially discouraging staking and impacting network security. To address this, the community approved Proposal #132, restoring the previous inflation range of 6.25%–12.5%. Since the network’s staking (bonded) ratio is still below the target level, inflation will continue to adjust within this range to maintain staking incentives and support validator revenues.

Let’s break down what this means and how long it will take for staking APR to stabilize under the new parameters.

How Inflation and Staking APR Work

In Proof-of-Stake (PoS) networks like Persistence One, inflation determines how many new tokens are minted and distributed as staking rewards. The system is designed to adjust dynamically based on how much of the total supply is staked.

The network aims for a goal bonded ratio of 67%, meaning 67% of XPRT should ideally be staked to ensure security. The protocol manages this by tweaking inflation:

- If staking is below 67%, inflation increases, boosting staking APR to attract more staking.

- If staking is above 67%, inflation decreases, reducing staking APR to maintain liquidity in the ecosystem.

Currently, the bonded ratio is 58.5%, meaning the network is under-staked. This activates the mechanism to gradually increase inflation (and staking APR) until the target is met or inflation reaches the new maximum of 12.5%.

How Long Will It Take for Staking APR to Increase?

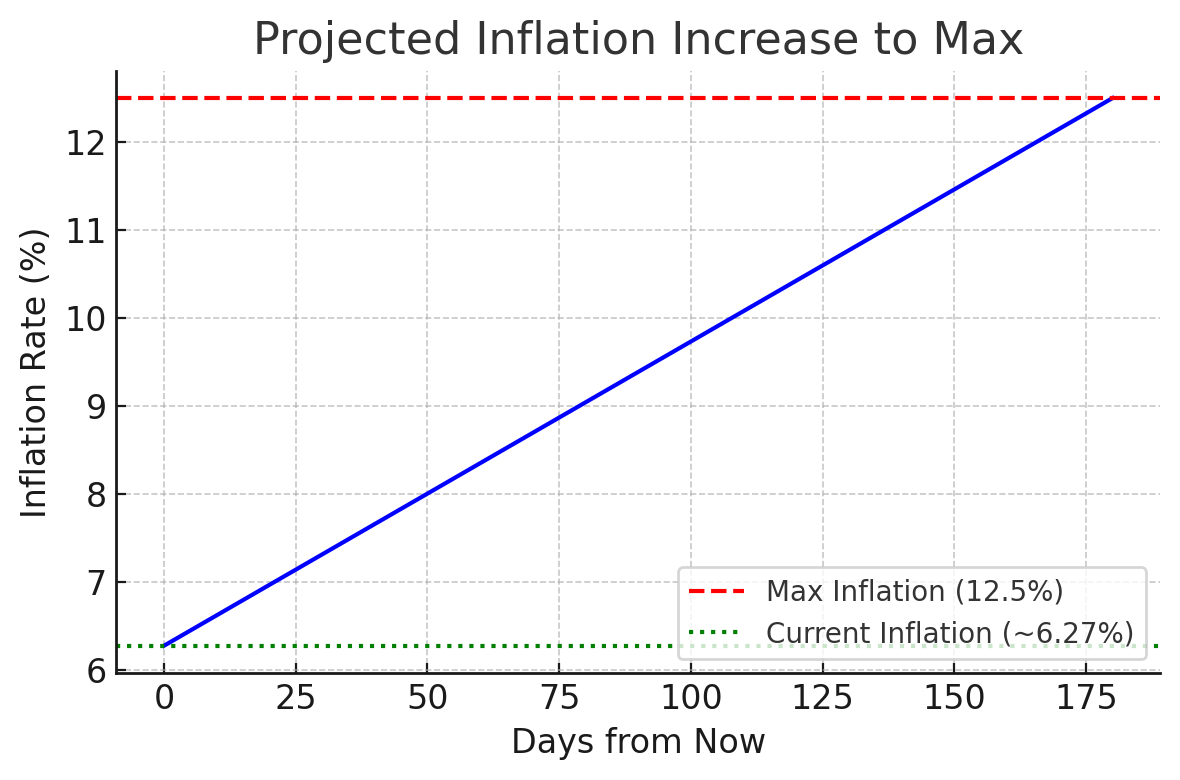

Key parameters that determine how inflation and staking APR adjust:

- Blocks per year: ~5,259,600

- Goal bonded ratio: 67%

- Current bonded ratio: 58.5%

- Maximum inflation: 12.5%

- Current inflation: 6.27%

- Inflation rate change: 1.00 (maximum from 0 to 100% in 1 year)

Projected inflation increase over time: starting at ~6.3% now and linearly reaching the 12.5% max in ~180 days (assuming the bonded ratio remains around 58.5%). Each day, the inflation rate ticks up slightly (blue line) until hitting the cap. This gradual rise translates to gradually increasing staking APR for stakers over the coming months.

If staking increases along the way, the inflation rate will settle somewhere between the minimum and the maximum as the target bonding ratio is hit.

What This Means for Stakers

The increasing inflation rate means staking rewards will rise gradually over the next six months. If staking APR today is around 10%, it could climb to ~20% as inflation moves toward 12.5%.

This change is not immediate – it’s designed to happen block by block, giving the market time to adjust. Higher staking APRs serve as an incentive to stake more XPRT, which in turn strengthens network security. If more holders stake, the bonded ratio moves closer to 67%, stabilizing inflation and staking APR.

Based on community forum discussion, it is reasonable to believe that this is in line with the current state of Persistence One’s long-term staking incentives.

While staking APR initially dropped with the latest parameter changes, it is now set to increase steadily over the next 6 months, bringing stronger incentives for staking. If you’re already staking, expect your staking rewards to grow over time. If you’re considering staking, the improving staking APR may be a good time to start. By mid-to-late 2025, staking rewards should be significantly higher, contributing to a more balanced and sustainable network security model.

About Persistence One

Persistence One is building the BTCFi Liquidity Hub, enabling fast, near zero-slippage swaps for XPRT, BTC-variants, and BTCfi tokens on Persistence DEX.

BTCFi’s rapid growth has created multiple BTC-related assets, making fragmentation a big challenge. Persistence One will provide a single liquidity hub, simplifying value transfer across the Bitcoin ecosystem.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]