tl;dr

- BTCfi has the potential to grow into a $250B+ industry if it can mirror Ethereum DeFi’s market share and address current challenges.

- Despite dozens of BTCfi players, the lack of interoperability between BTC variants hinders the ecosystem’s potential.

- Persistence One is set to introduce a solution for seamless BTC asset swapping, aiming to resolve the interoperability issue.

- Persistence One’s product will enable straightforward and efficient swapping across ecosystems of BTC derivatives using cross-chain intents, fostering greater innovation and usability in the BTCfi space.

With Bitcoin being welcomed into the traditional financial ecosystem through eleven recent Bitcoin ETFs, it’s unsurprising to learn that BTCfi is on the rise.

BTCfi, otherwise known as Bitcoin DeFi, encompasses decentralized finance platforms and applications built on top of the Bitcoin blockchain itself, either through a Layer 2 or a sidechain.

There are now dozens of BTCfi players in the space, many bringing their own BTC derivatives. However, the lack of interoperability between these BTC variants is one obstacle that needs to be overcome for BTCfi to thrive.

Persistence One is here to address that obstacle and is about to introduce a new product to the Bitcoin ecosystem that will allow users to bridge without bridging, powered by intents.

Let us explain.

BTCfi: A Fragmented Ecosystem Ready For Interoperability

Bitcoin DeFi is a rapidly growing segment in the crypto world, composed of Layer 2 protocols, sidechains, lending platforms, and yield-generating opportunities. The L2s and sidechains are designed to provide scalability and programmability to Bitcoin, allowing developers to create DeFi apps on the Bitcoin blockchain and take advantage of its gigantic security.

Most of these L2s or sidechains bring their own BTC variant (think FBTC, sBTC, mBTC, etc), which are typically pegged to Bitcoin. In addition to these L2/sidechain variants, wrapped and tokenized versions of Bitcoin, like WBTC, add to the number of BTC derivatives in the BTCfi ecosystem.

While dozens of BTC variants exist, each offering a unique utility in BTCfi, the lack of interoperability between each variable is still a major problem. Put simply, swapping one BTC variant for another is still far too complex for most users, leading to a fragmented BTCfi ecosystem.

Luckily, this is one problem that Persistence One is perfectly equipped to address.

Before we get into the solution, let’s take a quick look at BTCfi’s total addressable market size and why helping the ecosystem communicate is essential for its growth.

Total Addressable Market: Unlocking a $250B+ Industry

The total addressable market for BTCfi equates to a $250B+ industry over the next decade.

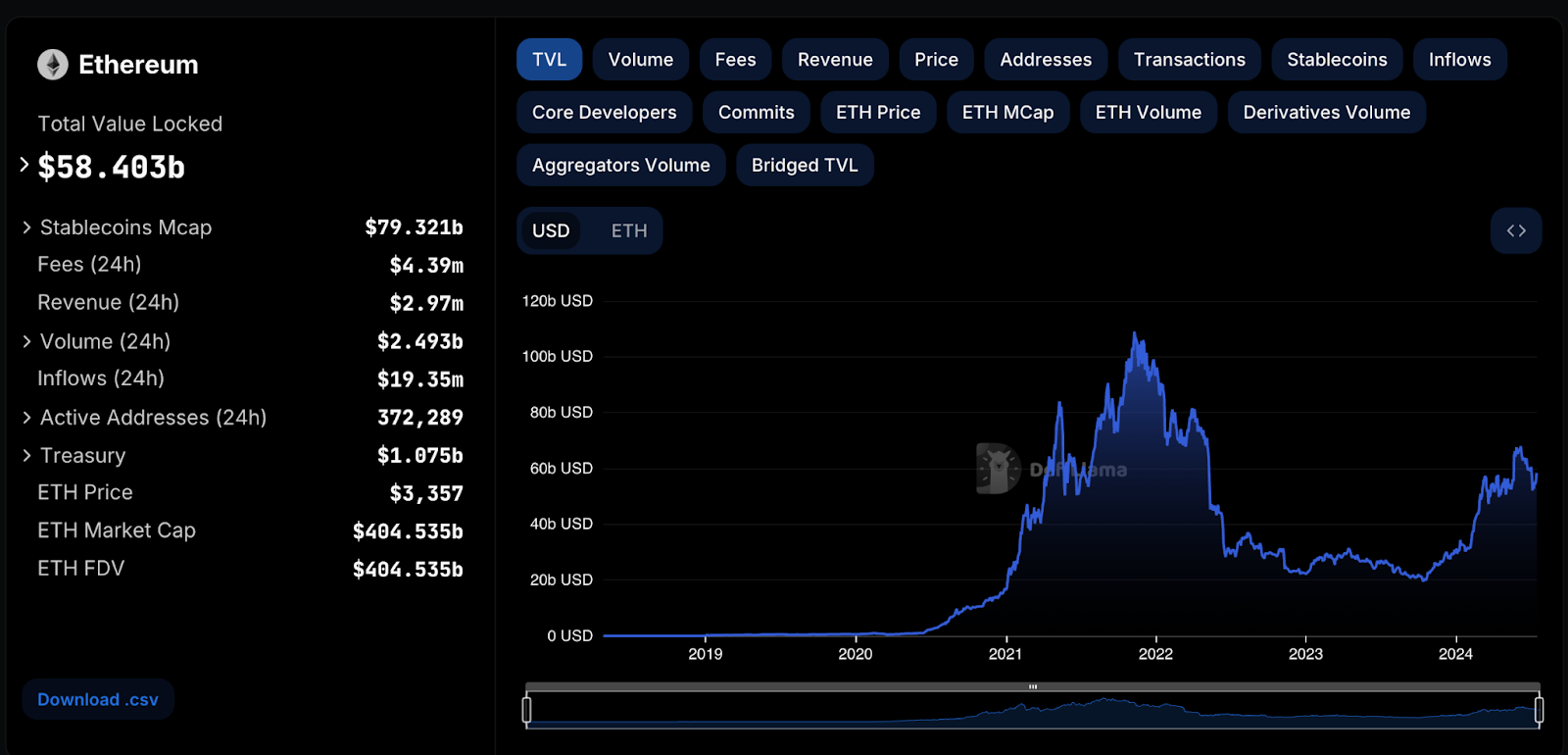

The TVL on Ethereum DeFi is roughly 15% of its current $400 billion market cap, meaning approximately $60 billion is locked into Ethereum DeFi.

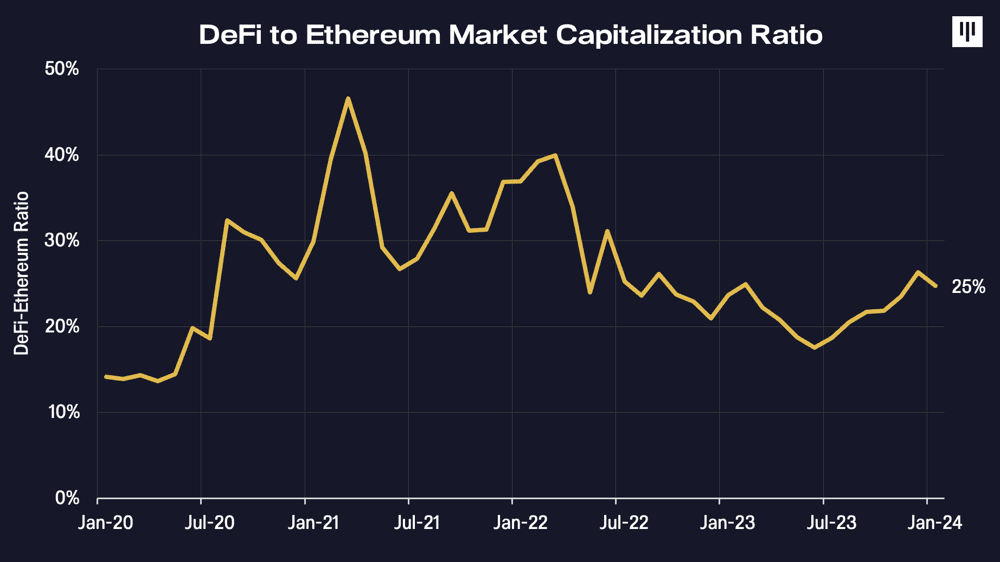

However, it’s important to note that the DeFi to Ethereum market cap ratio fluctuates wildly, with Pantera Capital suggesting it sits between 8% and 50% over the past four years;

The cryptocurrency-based hedge fund continued to suggest in a newsletter that BTCfi has the potential to accumulate as much as $450 billion in TVL, assuming the platforms can achieve a similar market share to what is seen on Ethereum DeFi.

For example, if BTCfi were to achieve a 10% market cap ratio, then the TVL on BTCfi would be as much as $120 billion at today’s $1.2 trillion market cap value. On average, Ethereum managed to stay above the 20% DeFi to market cap ratio. Therefore, if BTCfi saw a similar DeFi to market cap ratio, its TVL would surpass $250 billion.

As you can see, these numbers are significantly higher than the DeFi TVL on Ethereum, which is why so many eyes are being cast on BTCfi in 2024. If the BTCfi industry size closes in on $250B+ in the next decade, it’s unsurprising to see so many builders entering the ecosystem. However, to reach that magical $250B+ market size, BTCfi will need its ecosystem to become interconnected, removing the fragmentation it currently experiences.

Enter Persistence One and its BTC cross-chain swapping product, powered by intents.

Bridge Without Bridging: Cross-Chain Swapping Powered By Intents With Persistence

Persistence One is building a BTCfi interoperability product that provides fast, no-slippage cross-chain swaps for Bitcoin L2 assets – powered by intents and secured by Bitcoin.

We want to create a one-stop product for users wishing to seamlessly swap BTC L2 and related assets. Essentially, our solution will allow users to bridge BTC assets without bridging.

To achieve this, Persistence One will use a scalable liquidity solution without limitations through cross-chain intents.

Intents are a newly emerging piece of tech in the blockchain world. Put simply, an intent is best described as an order where the outcome is specified rather than the execution path. Traditionally, users would make an order on an AMM, say Uniswap, to swap USDC to ETH through a specific pool. This type of order specifies the outcome (swapping USDC to ETH) and the execution path (through the ETH V3 pool).

As an intent, this type of order would specify the outcome of the swap, i.e., swapping USDC to ETH, but the route to the swap is undetermined. Instead, a solver – a market maker – would then come along and fill that order.

Intents are a brilliant way to provide cross-chain interoperability for the BTCfi world, especially considering that most BTC derivatives are similarly priced. Intents provide improved execution and unified liquidity. They also enhance interoperability as users aren’t burdened with the complexities of navigating multiple protocols to swap from one chain to another. By using intents, Persistence One’s solution simplifies the process of swapping BTC assets, making it more accessible and user-friendly.

Persistence One is excited to build for Bitcoin and help push BTCfi in the right direction to reach its full potential through interoperability. By connecting the many variants of BTC, builders and users in the ecosystem can swap between BTC variants without having to worry about slippage or slow speed. As a result, BTCfi will see elevated innovation and continued growth with Persistence One’s user-friendly cross-chain swapping solution for BTC assets. It won’t just be BTC variants too, but other tokens will be supported. For example, in later stages, DEXes will be able to integrate so that any-to-any swaps can be facilitated as well, creating a well-rounded ecosystem at Persistence One.

About Persistence One

Persistence One is building a Bitcoin interoperability solution to enable cross-chain BTC swaps across Bitcoin Layer 2s.

The rapid rollout of Bitcoin L2s and side chains has led to fragmentation, hurting BTCfi scalability. Using the power of intents, Persistence One will enable users to move assets across Bitcoin Layer 2s more efficiently than traditional bridging, offering fast, secure, zero-slippage cross-chain swaps.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]