tl;dr

- The goal is to facilitate the transition from using BTC as a store of value and help it integrate into a broader BTCfi landscape.

- Bitcoin Layer 2s are emerging at lightning speeds to address scalability and composability issues within the Bitcoin network.

- Layer 2 solutions like Lightning Network, Stacks, Merlin, and Rootstock introduce unique BTC derivatives, expanding the BTCfi ecosystem.

- Interoperability is a emerging challenge as multiple BTC variants exist in isolated ecosystems, hindering BTCfi growth.

- Persistence One aims to connect Bitcoin Layer 2s through an interoperability solution, enabling fast, zero-slippage cross-chain swaps, powered by Intents, secured by Bitcoin.

Bitcoin remains the king of the cryptocurrency world, and the emerging Bitcoin Layer 2 landscape and its numerous BTC derivatives are a testament to its continued innovation. Developers are finally building on the Bitcoin blockchain itself, with an aim to address two of the most pressing issues related to the Bitcoin network: scalability and composability.

The solution lies in Bitcoin Layer 2s, which are built and deployed on top of the Bitcoin blockchain itself, creating a wealth of innovation for the number one ranked cryptocurrency.

With almost each of the Layer 2 solutions comes a BTC variant, or BTC derivative, that adds to the emerging BTCfi landscape.

However, with the Layer 2 ecosystem rapidly growing, a new problem is emerging: Interoperability.

With dozens of Layer 2s being built, let’s examine the many variations of Bitcoin in an expanding Layer 2 ecosystem and underline the crucial role that Persistence One intends to play in connecting them all.

The Emerging Bitcoin Layer 2 Market.

The Bitcoin Layer 2 landscape has flourished since the introduction of the SegWit and Taproot upgrades. SegWit improved memory efficiency in 2017, while Taproot introduced improvements in privacy, efficiency and smart contracts functionality in November 2021. As a result of these landmark upgrades, developers have been working hard to introduce a variety of Layer 2 solutions that address Bitcoin’s scalability and programmability issues.

The original Bitcoin network codebase has limitations, making it very difficult for developers to build directly on top of it. This stifles innovation for BTCfi to reach the heights of the DeFi ecosystem seen with Ethereum today. In addition, there’s a scalability issue at hand, with Bitcoin still only able to facilitate 7 TPS. The low transaction processing speed causes transaction fees to skyrocket during times of heavy blockchain loads, with users being forced to wait hours for transactions to be confirmed.

This is where Bitcoin Layer-2s step in with the solution.

In simple terms, Layer 2s are like additional layers built on top of the Bitcoin blockchain. They are designed to handle more transactions and tasks, thereby reducing the burden on the main Bitcoin blockchain. These Layer-2s are connected to the main chain for verification and settlement, but they run their own side chains for executing and processing transactions.

The general idea is to facilitate transactions and tasks off-chain to reduce the main workload of the Bitcoin blockchain. Then, the Layer-2s will report back to the Bitcoin blockchain, allowing the transactions to be recorded on the elite verification protocol. A complete Layer-2 will have the security of Bitcoin, smart contracts enabled, and the ability to transfer BTC in and out of the layer.

As a result, Layer 2s can introduce new forms of technology to Bitcoin, helping it scale better and provide decentralized applications built on its network.

These solutions offer a promising path forward for Bitcoin by addressing the limitations of the original codebase, introducing new ways to utilize digital money, and enhancing the speed at which it can be done.

Multiple Variations: Each Layer 2 Brings Its Own Unique Bitcoin Derivative

Now, dozens of Bitcoin Layer 2s are emerging, each with its own unique implementation designed to address composability or scalability for the main Bitcoin blockchain. Furthermore, each Layer 2 or sidechain brings its own unique Bitcoin derivative token, spawning an entire ecosystem of Bitcoin-related derivatives and wrapped versions of the native asset.

The first Layer 2 solution was the Lightning Network, designed to facilitate low-cost, high-speed transactions on a Bitcoin L2. Since the Lightning Network, dozens of Bitcoin derivatives have emerged, all with a unique vision to help expand the growing BTCfi ecosystem. Furthermore, a handful of tokenized versions of Bitcoin also exist, adding to the number of variations.

The following list contains just a few of the many prominent Layer 2s or side chains on the market right now with their BTC derivative:

- Stacks – SBTC and xBTC (wrapped Bitcoin)

- Rootstock – rBTC

- Liquid Network – L-BTC

- FBTC – FBTC

- Ren – renBTC

- Interlay – iBTC

- Merlin – mBTC

And then there are other BTC variants also, such as Wrapped BTC and yield-generating BTC.

- Wrapped Bitcoin – WBTC

- Solv Finance – solvBTC

- pSTAKE Finance – yBTC

- Lorenzo Protocol – stBTC

The problem is that all of these tokens are in their own ecosystems and the lack of interoperability between them. For BTCfi to become bigger and reach its full potential, these tokens on Layer 2 solutions need to be able to move between each other.

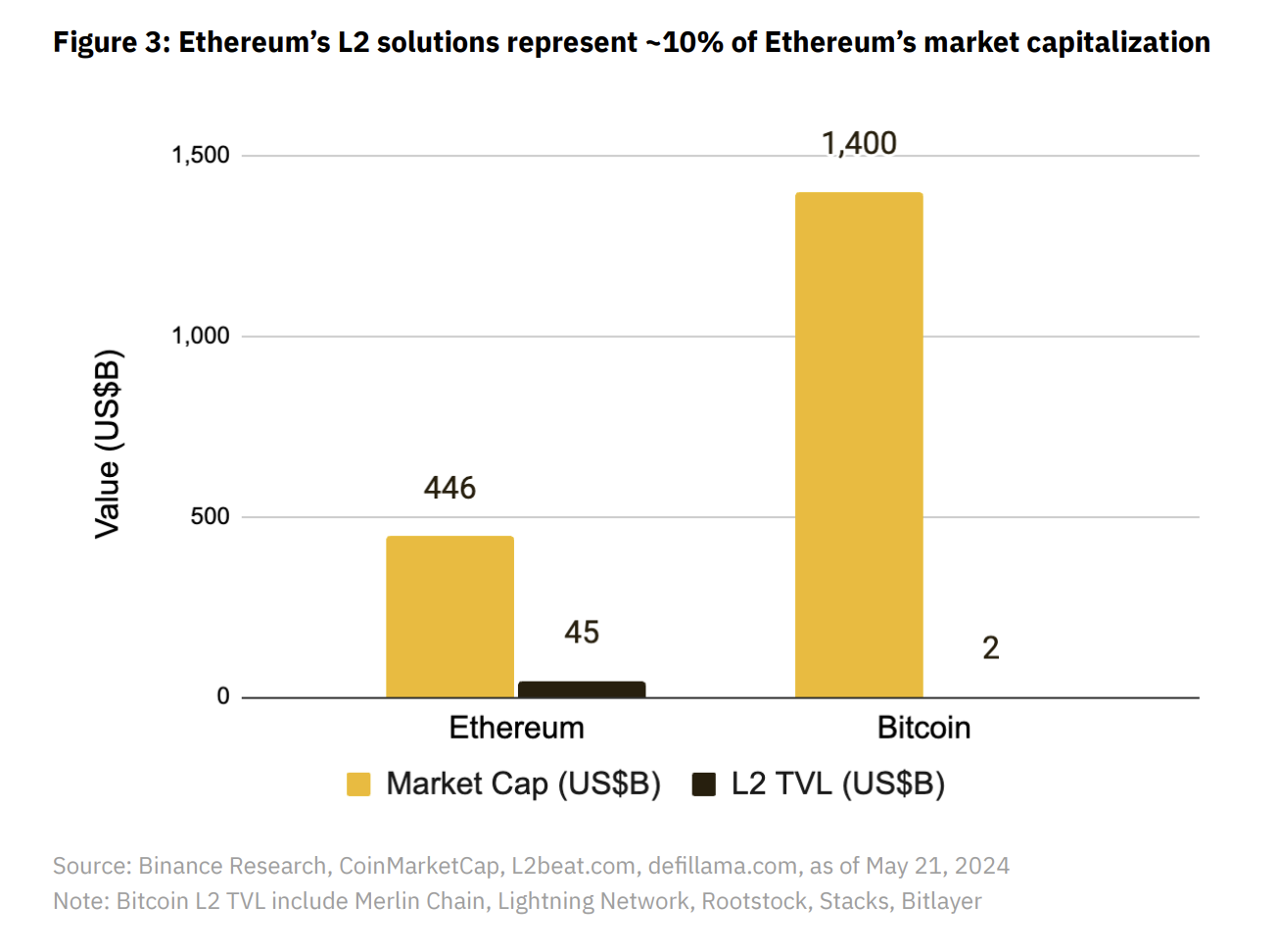

Although the BTCfi ecosystem is growing, Ethereum DeFi is still leading the charge. To put this into perspective, the total value locked (TVL) in Ethereum’s DeFi ecosystem represents around 10% of Ethereum’s market cap capitalization. In comparison, the TVL locked in BTCfi is just a tiny 0.13% of its enormous $1.4 trillion market cap value;

With BTCfi’s enormous potential, it will be essential to provide an outlet for users to move BTC and swap BTC derivative tokens seamlessly. Right now, swapping one BTC derivative for another is extremely difficult, and due to the lack of fungibility, it’s slowing the pace of growth for BTCfi. For example, people might have stablecoins on one chain and want to get different variations of BTC on other chains or they want to swap let’s say mBTC for sBTC. The solution is long-winded, involving multiple routes and exchanges to make it happen.

One solution is to leverage traditional bridges, which allow users to deposit tokens into a contract and receive another. However, these protocols are typically risky as they require a certain level of trust and are usually expensive.

Instead, a solution must be created that makes it seamless to swap assets across Layer 2s without requiring multiple operations.

This is where Persistence One steps in.

Persistence One: Bringing the Many Variations of Bitcoin Together

Persistence One is developing a venue for trading all forms of BTC cross-chain. We want to be pivotal in facilitating the move from using BTC as a store of value to using it in BTCfi.

With plenty of new BTC L2s emerging, moving assets between them is complex. Persistence One wants to revolutionize this with a one-stop interoperability solution for everything Bitcoin, providing a unique offering in the Bitcoin space.

We’re on a mission to connect Bitcoin L2s through an interoperability solution, enabling fast, zero slippage cross-chain atomic swaps for BTC assets, powered by Intents, secured by Bitcoin.

While DEXes utilize AMMs for swaps, these AMMs are not ideal for closely related assets, and definitely not when liquidity pairs are to be built cross-chain, which is why Persistence One’s solution will be using a Cross-chain Order Book methodology.

In addition, the strong alignment with Bitcoin is what sets Persistence One apart. The Persistence Core-1 blockchain, which will power the interoperability solution, will soon be secured by Bitcoin, via a security-sharing solution by Babylon. This means that the blockchain itself will leverage Bitcoin’s security, bringing us closer to our goal of helping move Bitcoin around.

Overall, Persistence One is now ultra-focused on building for Bitcoin, with its interoperability product set to provide the perfect solution for the emerging BTCfi ecosystem.

About Persistence One

Persistence One is building a Bitcoin interoperability solution to enable cross-chain BTC swaps across Bitcoin Layer 2s.

The rapid rollout of Bitcoin L2s and side chains has led to fragmentation, hurting BTCfi scalability. Using the power of intents, Persistence One will enable users to move assets across Bitcoin Layer 2s more efficiently than traditional bridging, offering fast, secure, zero-slippage cross-chain swaps.

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]