In our previous Restaking Deep Dive #1 and Deep Dive #2, we discussed the technical architecture for Cosmos Restaking on Persistence One and compared Restaking in Ethereum vs Cosmos.

This blog dives deeper into “Restaking as a Blockchain Security Model” and compares how it solves the most significant drawbacks of other security models like Replicated, Mesh, Babylon (BTC), and Ethos (ETH) security.

This is the final blog in our general Restaking series. In the next one, we will dive deeper into what Cosmos Restaking on Persistence One will look like.

Economic Security

What does economic security mean? Having 6-9 months of income? Ability to do something you love doing without a care in the world? The dollar value of tokens required to carry out a 33% attack on a Proof-of-Secrutiy chain?

While the word itself has numerous definitions and contexts in which it is used, Economic Security is like a fortress that guards financial well-being. A must for a thriving economy.

Economic Security of Blockchains can be considered analogous to Nations. There, a country can follow its policies to develop the national economy as desired. Here, it is the ability of economic trust provided by a blockchain for participants to build the on-chain economy in a consensualized manner.

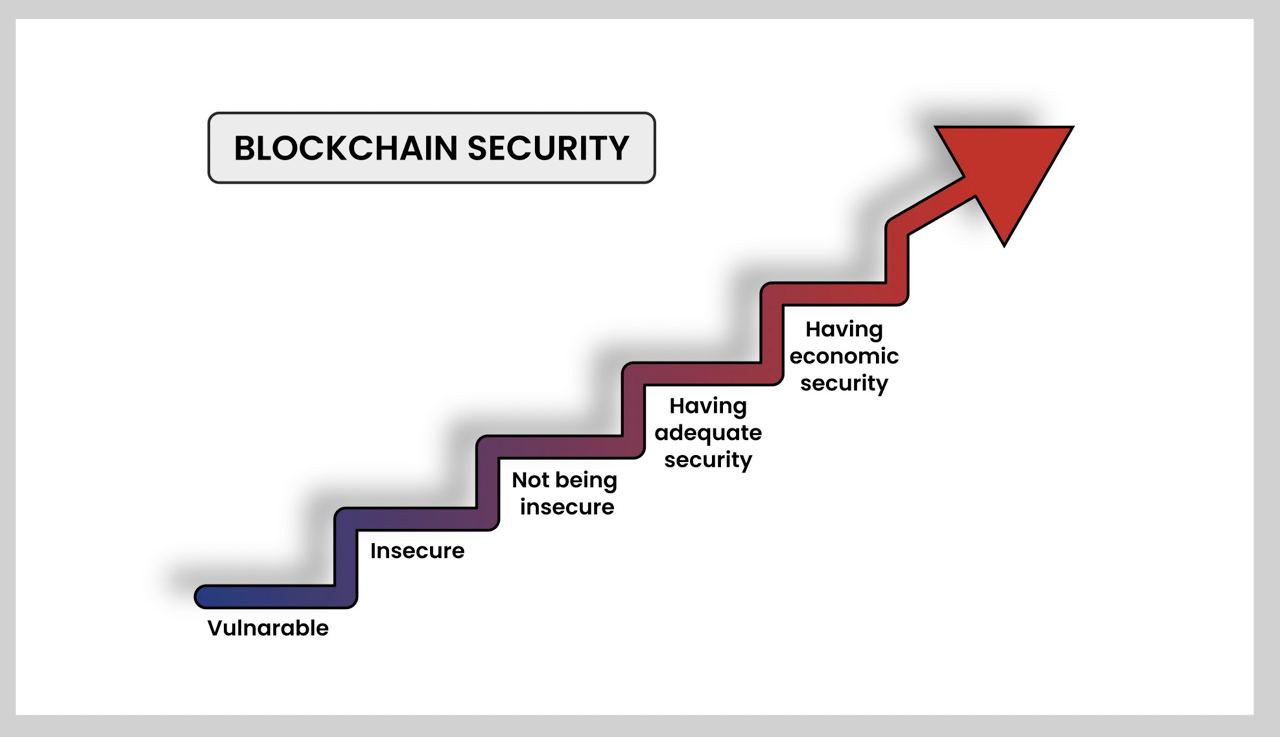

Currently, Economic Security’s goal is to have an inadequacy threshold. Security that would be insufficient to provide economic well-being of on-chain activity. In simpler words, it has always been easier to agree on “How much security is too little?” than on the question “How much security is enough”?

In line with that, most efforts end at raising the bar from being insecure to not being insecure. And that’s it. The focus for blockchains, on the other hand, should be to boost security to be diversified, hedged, and abundant.

Current Blockchain Security Landscape

Blockchain security works on the pillars of cryptography, immutability, and decentralization. No one can modify data without the knowledge of all other participants involved. This cements the position of blockchains as a tamper-proof trade environment.

At the same time, Blockchains also carry various security risks. Code Exploits, 51% attacks, Routing attacks, 33% and 66% attacks, endpoint vulnerabilities, and more exist. Threats to Blockchains depend on its consensus model’s security characteristics–Proof Of Work (PoW), Proof of Stake (PoS), etc.

Bitcoin remains one of the only top PoW networks. Blockchain Security and Consensus trends have moved to PoS with Ethereum, Celestia, Cosmos Hub, dYdX, Osmosis, Persistence One, and countless more. The most extensive utility of the native tokens of these PoS chains remains to provide security to the on-chain economy. However, the ever-decreasing nature of inflation (and staking rewards) and uncertainty over real yield from on-chain activity puts chain security at risk. Stakers might search for higher yields offered by the growing DeFi landscape.

Alternate Blockchain Security Models

Replicated Security

Replicated Security (or Interchain Security) involves one-to-many security.

With Interchain Security, Cosmos Hub (provider chain) creates blocks for another blockchain (consumer chain). This is achieved by sharing the entire/subset group of validators responsible for generating blocks via Cross-Chain Validation powered by Inter Blockchain Protocol (IBC).

ATOM stakers can extend the Cosmos Hub’s economic security to other chains and receive financial rewards from these consumer chains as part of an on-chain governance deal.

Mesh Security

Pioneered by Osmosis, Mesh Security involves many-to-many security.

With Mesh Security, multiple blockchains that are a part of the ‘mesh’ can secure each other. This is achieved with the concept of Virtual Staking. It involves an instance of Chain A’s token interacting with the native staking module of Chain B for cross-chain staking.

Mesh stakers can share economic security with all chains that are, ultimately, a part of the Mesh.

Babylon BTC Security

Babylon involves extending BTC security.

With Babylon, blockchains can borrow economic security from the Bitcoin network via a novel solution involving BTC Staking. It involves appending newly produced blocks to the Bitcoin blockchain, assuring that transactions within the block are genuine.

BTC stakers can extend Bitcoin’s economic security to chains that adopt Babylon’s services and earn yield from these networks.

Ethos ETH Security

Ethos involves extending ETH security.

With Ethos, blockchains can borrow economic security from the Ethereum network through Restaked ETH on EigenLayer. It involves validators to expand their security services beyond just Ethereum-specific applications into Cosmos.

ETH restakers can extend Ethereum’s economic security to chains that adopt Ethos’ services and earn yield from these networks.

Restaking as a Blockchain Security Model

Some of the biggest bottlenecks of the above Security Models involve the diversification of assets that provide security, extensive infrastructure requirements, user experience issues, uncertain sources of steady rewards, and more. While Replicated Security (ATOM), Mesh (tokens part of it), Babylon (BTC), Ethos (ETH) offer unique security solutions, they’re primarily dependent on a single large-cap token.

These pitfalls can be tackled and addressed by Restaking Anything with Persistence One. Any asset can secure any blockchain without meddling with the chain’s sovereignty, diversifying economic security, and giving users multiple sources of yield stacked together.

Let’s consider a small example of how Restaking on Persistence One could fare against the most significant drawbacks of other Chain Security Models.

| Drawback of Other Security Solutions | How does Persistence One Restaking solve it? |

| Externalizes Validator Set | The native chain’s token has its sovereign validator set per its requirement, negating any alignment or development worries. |

| Extensive Infrastructure needed | No additional or minimal infrastructure is needed as Restaking scales economic security with code rather than nodes. |

| Rewards are passive | Chain Governance can decide how much % of rewards to allocate to a particular restaking token, incentivizing any large cap asset to be a security provider and earn active yield. |

| Scaling depends on Business Development | Any chain with the Restaking enabled can tap into the economic security provided by any asset. |

| Native token loses utility | Restaking only adds to or hedges a chain’s security while the chain and token maintain full sovereignty, control, and utility. |

| Built at the application layer level | Users can enjoy isolated rewards and protect themselves with isolated slashing by being built on the protocol layer level. |

Final Thoughts on Restaking as a Security Model

With Restaking on Persistence One, any asset can be restaked to secure any chain in Cosmos. Restaking not only scales Security but also token utility. Restaking ATOM LSTs can scale ATOM’s role as a security provider in Cosmos, opening the door for any Cosmos chain to be a Restaking Consumer Chain and solidifying its position as Interchain Money.

ATOM is only one token. Restake Anything with Persistence One soon.

About Persistence One

Persistence One is a purpose-built Layer 1 on a mission to maximize yield and security through Liquid Staking and Restaking. It offers a technically advanced, secure, and robust infrastructure for modular and smart-contract dApps.

pSTAKE Finance is a Cosmos-focused LST issuance protocol for ATOM, OSMO, BNB, and DYDX built on Persistence One that empowers users to earn staking rewards while participating in DeFi.

Dexter is a decentralized exchange on Persistence One that offers capital-efficient trading and yield opportunities for LSTs, stablecoins, and other tokens.

Persistence One is bringing Restaking to Cosmos. Become a Persister today!

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]