The parabolic adoption of Liquid Staking has seen a clear product-market fit in the Ethereum Ecosystem. The ETH staking market has grown to $100B+. Its derivative counterpart, liquid staking, grew 4X last year with $47B+ ETH liquid staked. The newest entrant in the world of Proof-of-Stake, Restaking, has taken the crypto industry by storm and has grown to a $9.5B+ market in only months.

In the previous Restaking Deep Dive #1, we discussed the technical architecture for Cosmos Restaking on Persistence One. This blog dives deeper into the evolution of Proof-of-Stake leading up to Restaking in its quest for capital efficiency and compares the Restaking landscape on Ethereum and Cosmos.

Evolution of Proof-of-Stake

What is Proof-of-Stake?

Before diving two layers deeper into the world of derivatives, let’s briefly understand one of the most adopted blockchain consensus mechanisms in the world, Proof-of-Stake (PoS). Consensus involves constant agreement on a network’s state (data, transactions, balances, etc.). While Proof-of-Work relies on computational firepower (mining) to achieve and maintain network consensus, PoS includes the concept of Security Bonds.

When we need to trust other people/counterparties to behave well, security deposits are often instituted to guarantee good behavior. A typical example is Landlords taking security deposits from tenants.

Staking allows holders of native PoS tokens to lock up tokens to participate in a blockchain’s consensus mechanism, including block production and transaction validation. This locked capital (stake) contributes to the overall network security and earns staking rewards that usually comprise the token’s inflation and the network’s transaction fees.

Network Effects of Proof-of-Stake

PoS is a network of network effects. While Traditional Finance is considered the time value of money, PoS can be viewed as the network effects value of money.

The Ikea Effect is a cognitive bias that helps explain why people place higher value on things they helped to build or create. PoS, as a monetary network, upholds this effect firmly. Community Members (token holders) have an active say in who runs network nodes (validators).

For eg. ETH or ATOM stakers help uphold network security, get rewarded for it, and, at times, might get punished in case of malicious behavior (slashing). This fosters a deeply engaged, concerned, and vocal community, creating various network effects in PoS.

Cosmos and Ethereum Proof-of-Stake Landscape

All roads originate from Cosmos. All roads lead to Cosmos.

While Tezos was the earliest blockchain to adopt PoS, the idea, like most revolutionary ones in crypto, was born out of Cosmos. PoS further evolved into various types depending on the needs of app chains like Proof of Authority (PoA), delegated Proof-of-Stake (dPoS), Proof of Importance (PoI), etc.

The key to understanding the growth of the Liquid Staking and Restaking dynamic in these ecosystems lies at the microscopic layer of how PoS differs in these Ecosystems.

| Attribute | Ethereum | Cosmos |

| Consensus | Proof-of-Stake | Delegated Proof-of-Stake / CometBFT |

| Ecosystem Early Days | DeFi-first | Staking-first |

| Running Nodes | Difficult to run infrastructure | Simple and easy-to-run on-chain validator |

| Solo Staking | Huge barrier to entry with 32 ETH required to be a Node Operator | Great UX with delegating non-zero stake amount to validator of choice |

| Staking Rewards | Inflation and Network Fees | Inflation and Network Fees |

| Transaction Finality | ~13 minutes | Instant |

| Changes to blockchain infrastructure | Contributors and EIPs | Native Token Governance |

| Performance | 20-30 TPS | Depends on chain (as high as 10,000+) |

Ethereum Liquid Staking and Restaking

A higher barrier to entry for solo staking, a flourishing DeFi ecosystem and high yields, and access to deep liquidity with no unstaking in the early days of ETH liquid staking were the core reasons behind the parabolic adoption of ETH liquid staking.

Growth in liquid staking resulted in Ethereum’s more robust and increased economic security. However, the core utility of staked ETH remained the same–secure the chain and validate transactions. Blue-chip DeFi yields decreased as staked ETH became the most widely adopted collateral. A highly secure network and a flourishing liquid staking landscape searching for more capital efficiency and yields laid the idea of Restaking on a red carpet.

In hindsight, the emergence of a trust marketplace that offers bridges and a whole bunch of applications or Active Validated Services (AVS) like oracles, bridges, rollups, data availability, etc. to leverage the economic security of the second biggest blockchain in crypto was inevitable. EigenLayer Restaking.

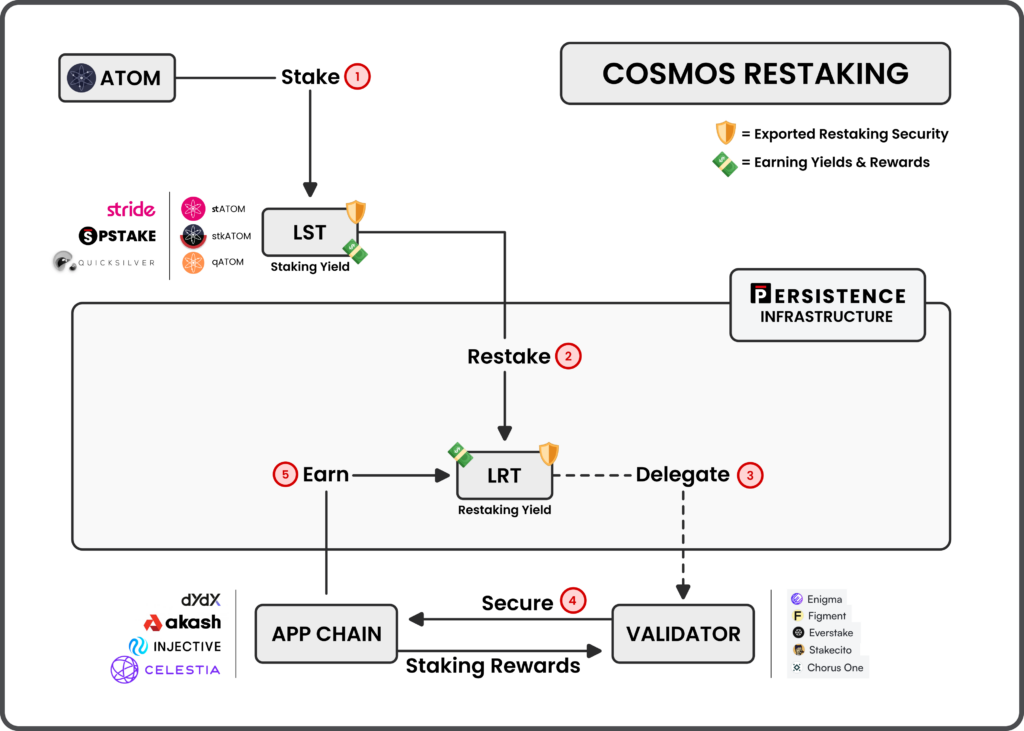

Cosmos Liquid Staking and Restaking

Arguably, on Cosmos, building a delegator-first grounds-up staking infrastructure, high token inflation, and lack of DeFi in the early days were the main reasons behind the widespread adoption of staking, thus causing a significant barrier to entry to liquid staking when it was introduced.

The grassroots adoption of staking has ensured that app chains have sufficient economic security. The ever-decreasing nature of a chain’s native token inflation (and staking rewards) puts chain security at risk as stakers might search for higher yields offered by the growing DeFi landscape. The need for a collectively secure Cosmos, flourishing DeFi, and other applications is knocking on the door.

In foresight, the emergence of an Alliance Infrastructure where app chains secure each other to offer sustainable economic security and give birth to a collateral token that captures the economic value of all these chains will be inevitable. Persistence One Restaking.

Ethereum and Cosmos Restaking Comparison

| Attribute | Ethereum | Cosmos |

| Protocol | EigenLayer | Persistence One |

| Restaking Tokens | Ether (ETH) | – LSTs: ATOM, OSMO, DYDX, INJ, KUJI, etc. – Stablecoins: USDC, USDT – LP Tokens: Dexter, Osmosis, Astroport |

| Example User Action | Restake Lido staked stEth to EigenDA | Restake liquid staked TIA to Persistence One |

| Where do yields come from? | AVS like Oracles, DA, bridges, Rollups, etc | Staking Rewards of app chains |

| Total Addressable Market | Applications in need of security | Entire app chain market |

| Slashing | EigenLayer and Ethereum have different slashing conditions | Slashing of restaked tokens on a particular chain is limited to that chain only |

| Scaling | Onboarding new Operators and AVS | Plug-and-play Restaking Module by Persistence One present on app chain |

| Rewards UX | Operators choose the AVS they will validate with restaked ETH | Users decide to Restake any token of choice to combine rewards |

| Liquid Restaked Tokens | Already existing from protocols like Kelp DAO, Renzo, Etherfi | Combines staking rewards of two chains. Eg. LRT with TIA and XPRT staking rewards |

| Sovereignty | AVS are dependent on Ethereum | Restaked tokens add to a chain’s economic security but do not contribute to governance |

| Risks | – Creates an additional layer of leverage – Slashing Risk of the underlying staked ETH on Ethereum – Centralization Risk | – Creates an additional layer of leverage – Exposure to Slashing Risk of multiple app chains – Restaked token (of Chain A) could overpower Chain B’s native staked token |

Final Thoughts on Restaking

The world is headed towards multiple secure and interoperable PoS blockchains with flourishing DeFi. In this world, Staking becomes the fixed income of crypto.

Restaking won’t just be a narrative. Restaking has cemented itself as the next natural progression of the PoS Landscape as stakers search for new sources of secure yield. At the same time, applications remain on the lookout to hedge and/or increase security. Essentially, Restaking creates a trust marketplace in this trustless, decentralized world.

Does Restaking add another layer of leverage over the current liquid staking layer? Yes

Will Restaking make the overall system more capital-efficient with minimal risk added? Let’s find out.

About Persistence

Persistence One is a purpose-built Layer 1 on a mission to maximize yield and security through Liquid Staking and Restaking. It offers a technically advanced, secure, and robust infrastructure for modular and smart-contract dApps.

pSTAKE Finance is a Cosmos-focused LST issuance protocol for ATOM, OSMO, BNB, and DYDX built on Persistence One that empowers users to earn staking rewards while participating in DeFi.

Dexter is a decentralized exchange on Persistence One that offers capital-efficient trading and yield opportunities for LSTs, stablecoins, and other tokens.

Persistence One is bringing Restaking to Cosmos. Become a Persister today!

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]