Persistence is the cosmos app chain for Liquid Staking DeFi (LSTfi). You can learn more about Persistence and its vision, ecosystem dApps like pSTAKE and Dexter, XPRT utility, and what’s coming next in the Persistence LSTfi Ecosystem overview blogs here.

This blog will empower you with everything you need to know about XPRT staking : what it is, why it is essential, how to stake XPRT and general FAQs. Let’s dive right in.

Introduction to XPRT staking

Cosmos app chains follow a ‘consensus mechanism’ called Proof of Stake (PoS), ensuring that all transactions are verified and secured without a middleman or intermediary. If a token is staked, it becomes a part of this process and gets locked up for a minimum period (called an unbonding period that varies from chain to chain).

XPRT is the native token of the Persistence Core-1 chain. XPRT is a multipurpose inflationary token that plays various roles in the Persistence LSTfi ecosystem:

- Chain Security by XPRT staking

- Decentralized LSTfi Governance

- On-chain LSTfi Traction

- Pay for transaction fees

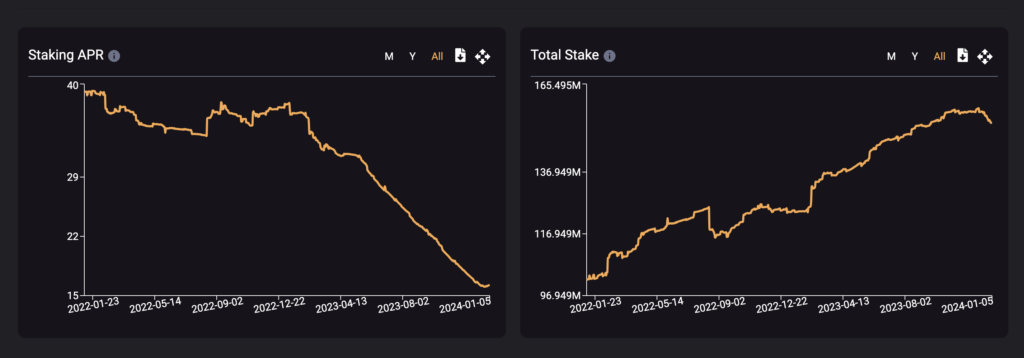

XPRT, like most other Cosmos app chains’ native tokens, is an inflationary token to uphold chain security. This involves network participants like stakers (or delegators) to stake XPRT with validators for block production and validation in return for XPRT rewards. XPRT staking rewards currently comprise XPRT inflation and XPRT from transaction fees. In the future, ecosystem dApps may share revenue with XPRT stakers, a decision that the XPRT governance can take. Currently, 90% of XPRT inflation is distributed as staking rewards, and the remaining 10% goes to the XPRT Community Pool.

The XPRT bonded ratio (% of token supply that is staked) defines the economic security of the Persistence. Historically, the Persistence core-1 chain has maintained a ~75%+ bonded ratio, one of the highest among all PoS chains in crypto.

Now that we have looked at what staking is and why XPRT staking is essential to the Persistence Ecosystem let’s look at some of the Frequently Asked Questions (FAQs) about XPRT staking.

XPRT Staking Frequently Asked Questions (FAQs)

How to stake XPRT?

XPRT tokens can be staked through one of the leading Cosmos wallets like Keplr Wallet, Leap Wallet, or IBC Wallet by Cosmostation.

Once you have set up your wallet and added XPRT tokens, navigate to the respective staking dashboard on the wallet, choose a validator to stake with, and sign the relevant wallet transactions.

Here are some community guides and tutorials to help you get started with XPRT staking:

- How to stake XPRT with Keplr Wallet video tutorial by Staking

- How to stake XPRT with Leap Wallet guide by Everstake

- How to stake XPRT with Cosmostation Wallet and Ledger by stake.fish

Which validator to stake XPRT with?

Choosing a validator is your right as a delegator. XPRT validators are the bedrock of the core-1 chain and contribute to the ecosystem with tech, governance, infrastructure, and social support.

Some things to consider while choosing a validator are commission, uptime, governance participation, slashing history, validator rank (lower rank better for chain decentralization), social support, delegator customer support, etc.

You can also delegate to multiple validators that align with your ideal validator parameters for a diversified delegation of stake.

Why is there a 21-day unbonding period?

The unbonding period is to help secure the network. A 21-day unbonding period ensures no sudden unbonding shocks, security concerns, or malicious activities on the network.

Can I transfer my staked XPRT tokens between wallets? Do I need to unstake?

Yes, you can transfer staked XPRT tokens between wallets. No, there is no need to unstake your tokens to transfer tokens. You can learn more about the exact step-by-step process by following our guide.

How are staking rewards generated? Do I need to claim them?

XPRT staking rewards are generated from XPRT inflation and transaction fees. In the future, ecosystem dApps may share revenue with XPRT stakers, a decision that the XPRT governance can take.

You can claim your XPRT staking rewards from your wallet directly. You will need to sign a wallet transaction to claim rewards.

How can XPRT staking rewards be auto-compounded?

XPRT staking rewards can be auto-compounded through third-party applications like Yieldmos, REStake, etc.

Please note that this information is only for educational purposes and not a recommendation to use these platforms.

When is liquid staked XPRT launching? Will I need to unstake for it?

Liquid Staked XPRT (stkXPRT) is poised to launch in Q1 2024 with tight integration with Dexter, the liquidity hub on Persistence.

No, you don’t need to unstake XPRT to liquid stake it. XPRT stakers can instantly convert their staked XPRT tokens into a liquidity position on the stkXPRT/XPRT pool on Dexter with a single click.

A detailed guide will be published on the blog once stkXPRT is launched.

What do I do if my validator is shutting down their node? Do I need to unstake?

You can redelegate your staked XPRT tokens to a different validator from your wallet if your current validator shuts down their node. No, you do not need to unstake your tokens.

Will I get XPRT staking rewards in the 21-day unbonding period?

No, you will not receive XPRT staking rewards in the 21-day unbonding period if you have unstaked your tokens.

Can I cancel the XPRT unbonding that is in progress?

Yes, ongoing XPRT unbondings can be cancelled anytime during the 21-day unbonding period. You can learn more about the exact step-by-step process by following our guide.

How frequently are XPRT staking rewards generated?

XPRT staking rewards are generated every block. In the Persistence core-1 chain context, the block time is every ~6 seconds.

Do I lose ownership of my tokens if I stake my tokens?

No, you still control ownership over your tokens if you stake tokens with a validator. Your seed phrase and other security accesses are the only way that ownership of tokens can be changed.

Please be careful while connecting your wallet to any website and always reverify.

Why should I stake my XPRT tokens?

XPRT holders can stake their tokens to help secure the Persistence core-1 network and, in exchange, can receive staking rewards.

How are XPRT staking rewards calculated?

XPRT Staking Rewards depend on the network’s bonded ratio (total % of supply that is staked). If less than two-thirds of the total XPRT supply is staked, the annualized inflation (major contributor to staking rewards) increases from 10-25% until two-thirds of all XPRT is staked again.

What are the risks of delegating to validators?

Validators can be subject to slashing, a penalty on their bonded tokens, and tokens delegated to them if they don’t follow network rules. Slashing events can also happen during the 21-day unbonding period.

Slashing happens for two reasons: Double signing (validator signs two blocks at the same chain height) and Downtime (validator remains unavailable to sign blocks for a certain amount of time).

Are there risks to XPRT staking?

XPRT staking is subject to a lockup period where tokens can’t be withdrawn. Unbonding tokens to receive liquid XPRT tokens will require 21 days. Validator risks like Slashing mentioned above are also applicable. Before staking, it is recommended to research the network, its rules and risks, and validators.

If you still have questions or need clarification with XPRT staking, please contact the Persistence support on Telegram.

About Persistence

Persistence is a cosmos app chain for Liquid Staking DeFi (LSTfi) with the issuance of & DeFi for LSTs.

The Persistence core-1 chain hosts pSTAKE Finance–a multi-chain liquid staking protocol for issuing LSTs that allows users to earn staking rewards while participating in DeFi primitives, and Dexter–the Interchain DEX for yield-generating assets like LSTs.

Persistence aims to offer a one-stop shop for liquid staking for PoS (Proof-of-Stake) users and enable developers to build innovative applications around LSTs.

Become a Persister today!

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]