While staking has certainly proven to be a viable means of earning rewards for PoS ecosystem participants, it comes with certain limitations. In particular, stakers are required to lock their assets within PoS protocols, limiting their ability to earn due to illiquidity, therefore forcing them to choose between staking and pursuing yield-generating opportunities in DeFi.

More PoS tokens (e.g. ATOM) utilized for DeFi activities instead of staking means fewer tokens securing the chain, which is an essential component that allows PoS networks to thrive.

Now, there’s a new and promising alternative to traditional crypto staking as we’ve known it — liquid staking. This new mechanism allows users to tokenize their staking position, providing them with additional liquid assets that can then be utilized across other DeFi products and applications. This means through liquid staking, stakers can now pursue other avenues to earn additional yield while maintaining core positions of their staked assets.

In late 2021, the TVL across liquid staking protocols was approximately $10.5 billion. Today this number stands at over $19 billion and is rising quickly as innovation continues to expand across various ecosystems.

Below we’ll explore the innovators bringing liquid staking to the Cosmos ecosystem.

Why Cosmos is Ripe for Liquid Staking

Within the last year, the Cosmos ecosystem has made a meteoric rise in the DeFi realm, growing at exponential rates by amassing over $33 billion in TVL (Total Value Locked) across top chains such as Terra, Osmosis, Cronos, and more. As a direct result, a large number of new users have flocked to Cosmos looking to leverage its vast suite of protocols and dApps.

This provides new opportunities for ecosystem participants, but stakers (the core contributors to PoS networks) are unable to take advantage of DeFi due to their assets being locked.

Currently, Cosmos has around 186 million ATOM staked (over 63% of all tokens in the circulating supply). As the number of stakers within Cosmos continues to increase alongside the growth of the DeFi ecosystem, the demand for additional yield from staked assets also increases.

Now, liquid staking solutions within Cosmos are beginning to pick up steam and further drive DeFi adoption — and quickly. Many ambitious projects are building and implementing mechanisms that provide increased utility to staked assets.

So why is the idea of liquid staking so well-suited for Cosmos in particular? Cosmos has the robust infrastructure required to support an entirely new economy of tokenized assets — it allows users to benefit from extremely low fees, blazing-fast transaction speeds, exponential scalability, top-notch security, and much more.

Moreover, its extensive interconnected web of IBC-enabled blockchains allows for seamless and optimal interoperability between supported digital assets, maximizing their application and spreading opportunity to all participants. Liquid staking presents an entirely new asset class that vastly broadens the reach of these prospects, accruing immense value in an all-encompassing manner.

The Cosmos Liquid Staking Landscape

Within Cosmos, several projects are leading the charge when it comes to implementing liquid staking solutions. Some current solutions cater to ATOM stakers by issuing liquid assets on Ethereum, some are building native implementations within the Cosmos ecosystem, and some are taking a multi-chain approach.

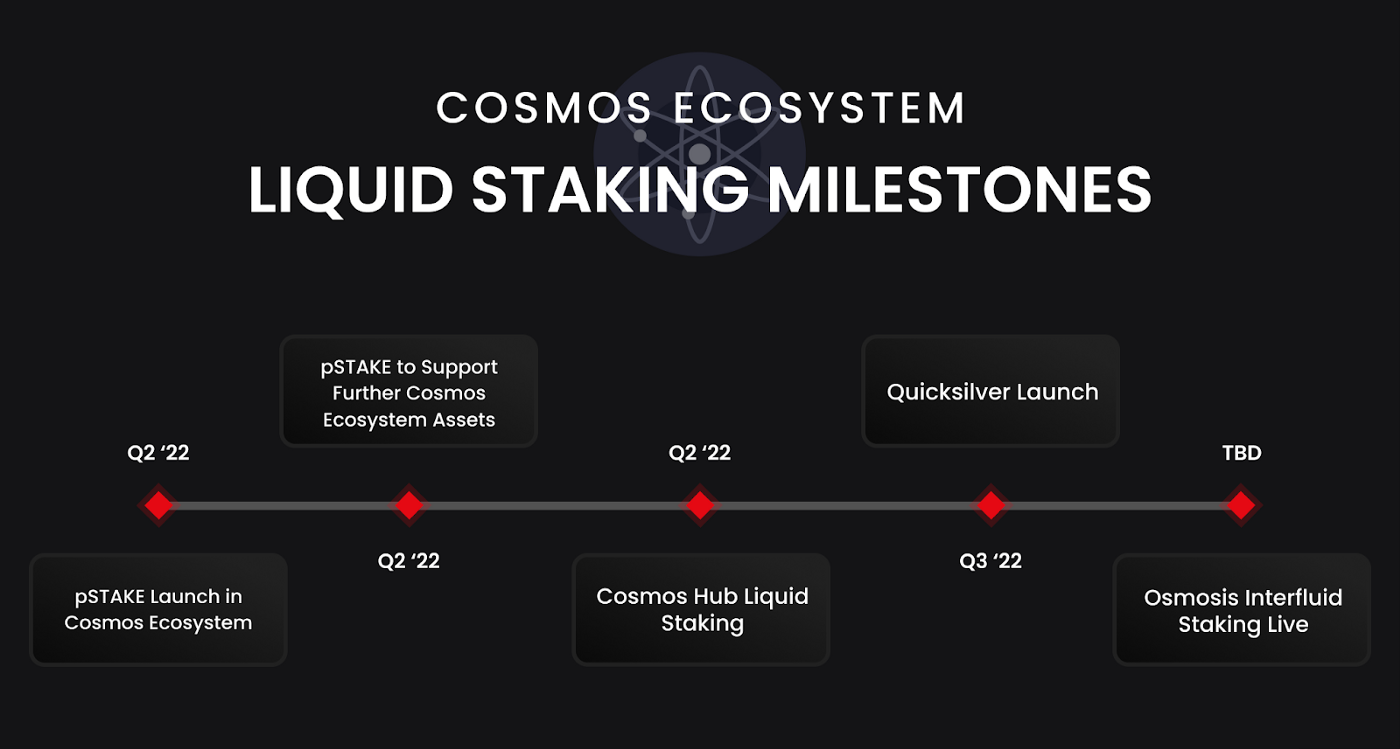

Some liquid staking solutions, like pSTAKE, are live now and building traction, whereas others are in the works and expected to launch from Q2 2022.

Here’s a high-level overview of what’s currently live and in development.

Lido Finance

Lido Finance is a popular liquid staking protocol running on Ethereum, Terra, Solana, Kusama and Polygon. Although the protocol doesn’t currently support ATOM, they’ve expressed plans to support the token by leveraging the liquid staking module on Cosmos SDK.

For now, their integration of liquid staked assets on the Terra blockchain provides Lido with a direct connection to the Cosmos DeFi ecosystem. Lido powers bETH, the second collateral asset supported by Terra’s Anchor Protocol.

StaFi

StaFi supports liquid staking for a wide variety of PoS assets. Upon staking their assets with StaFi, users receive rTokens, which can be exchanged and traded while continuously earning staking rewards. It’s one of the few platforms to currently support liquid staking for ATOM, although its current TVL in ATOM is relatively small (approximately $380,000 at the time of writing).

Osmosis (Superfluid Staking)

Osmosis has quickly grown to become the leading DEX in the Cosmos ecosystem. In March 2022, Osmosis launched its Superfluid Staking mechanism (a variant of liquid staking) which is now live for its ATOM/OSMO, UST/OSMO and LUNA/OSMO pools. Superfluid Staking allows liquidity providers to receive additional yield, generated via staking rewards — 50% of the user’s OSMO liquidity provided position (25% of the user’s total pool position) is staked when electing for Superfluid Staking.

Superfluid Staking provides a seamless mechanism for OSMO liquidity providers to generate additional yield, though it carries certain limitations compared to other liquid staking solutions. With Superfluid Staking, only 25% of the user’s pool position is generating additional yield (currently around $269 million of total OSMO across the supported pools) and the DeFi yield-generation opportunities are restricted to Osmosis. Further, there is no opportunity for instant liquidity on a user’s staking position due to the 14-day liquidity bonding requirement.

Although Superfluid Staking is currently only available for OSMO, Interfluid Staking for ATOM and other assets is in the works.

Cosmos Hub

Cosmos Hub was the first blockchain to be launched within the Cosmos ecosystem and sits at the very center of the broader network. The implementation of liquid staking for Cosmos Hub is currently in the works, with Zaki Manian and the Iqlusion Liquid Staking Working Group building to bring this to life.

The key benefit of liquid staking on Cosmos Hub, as with other ATOM liquid staking solutions, is that ATOM token holders will be able to both secure the underlying network while also pursuing other DeFi opportunities, increasing economic activity for the native token.

Cosmos Hub liquid staking will launch alongside the Rho upgrade expected Q2 of 2022.

Quicksilver Protocol

Quicksilver Protocol is a liquid staking protocol being built on Cosmos that works like a middle man between users and pre-existing staking protocols. Users can stake across multiple providers instead of under one umbrella, giving more autonomy to users.

The project recently completed its initial testnets and plans to deploy an incentivized testnet into Q2 2022, with launch planned for Q3 2022. While still in its very early stages in terms of reaching a fully working product, Quicksilver presents an interesting approach to liquid staking.

pSTAKE

pSTAKE is Persistence’s liquid staking protocol unlocking liquidity for staked assets. Holders of ATOM and XPRT (other PoS assets within Cosmos and beyond coming soon) can stake their native PoS assets and directly mint 1:1 stkASSETs (representing the staked assets). stkASSETs can then be used to engage in DeFi activities on the Ethereum network (and soon within the Cosmos ecosystem) to generate additional yield.

pSTAKE is one of the few liquid staking protocols currently live with ATOM support and is the most prominent by ATOM TVL, now sitting at $31 million. Though currently issuing stkASSETs on Ethereum, pSTAKE will directly extend its reach to the Cosmos ecosystem in Q2 of 2022 by launching on the IBC-enabled Persistence Core-1 chain. This means stkASSETs will be able to flow through the Cosmos DeFi ecosystem.

pSTAKE is pursuing further DeFi integrations for its stkASSETs, including onboarding bATOM (wrapped stkATOM on Terra) as collateral on Anchor Protocol. bATOM on Anchor would provide the first DeFi borrowing use-case for ATOM stakers, enabling new opportunities for the Cosmos community. Liquid staking support for other popular assets such as ETH, SOL and other IBC assets is coming to pSTAKE in Q2.

The Liquid Revolution Coming to Cosmos

As a whole, liquid staking will have a profound impact on the networks, stakers, and DeFi protocols within the Cosmos ecosystem. Principally, it opens the door for greater distributed liquidity and token utility across all interconnected chains, boosting activity and yield opportunities across the board.

This ultimately translates into more TVL and activity across all chains to allow interconnected networks (and their participants) to multiply and prosper.

Many of the aforementioned projects are still in the beginning to mid-stages of the development of these liquid staking solutions but are progressing well along the continuum. As the technology continues to blossom, Cosmos is poised to leave a firm footprint on the broader industry through these solutions and innovations.

About Persistence

Persistence is a Tendermint-based, specialised Layer-1 network powering an ecosystem of DeFi applications focused on unlocking the liquidity of staked assets.

Persistence facilitates the issuance and deployment of liquid-staked stkASSETs, allowing users to earn staking rewards while participating in DeFi primitives, such as lending/borrowing and liquidity provisioning on DEXs.

Persistence aims to offer a seamless staking and DeFi experience for PoS (Proof-of-Stake) users and enable developers to build innovative applications around stkASSETs.

Join Our Movement

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]