pSTAKE is one of the fundamental building blocks of the Persistence ecosystem, playing a key role in realising Persistence’s vision of becoming the liquid staking hub of the Proof-of-Stake industry.

With the role of XPRT within the Persistence ecosystem clearly defined, this article aims to delineate the relationship between $XPRT and $PSTAKE, and how they will work in tandem to propel Persistence on our mission.

What is pSTAKE?

pSTAKE is a liquid staking protocol (developed by Persistence) unlocking the liquidity of staked assets. PoS token holders can stake their assets with pSTAKE while maintaining the liquidity of these assets.

By staking with pSTAKE, users earn staking rewards while also receiving 1:1 pegged representative tokens (stkASSETs) which can be used to generate additional returns in DeFi. The native assets of users are staked with a set of top-performing validators on the underlying networks.

pSTAKE is bridging the PoS and DeFi sectors, by providing users with the ability to:

- Earn PoS staking rewards by staking the underlying assets and supporting network security

- Generate additional yield in DeFi by utilising stkASSET-supporting DeFi protocols

pSTAKE currently supports liquid staking for Cosmos (ATOM) and Persistence (XPRT), issuing stkATOM and stkXPRT. Support will soon be expanded to other leading PoS assets such as ETH, SOL, BNB, etc. in addition to major Tendermint-based assets, for which stkASSETs will be issued on the IBC-enabled Persistence Core-1 chain.

pSTAKE and the Persistence Ecosystem

As highlighted in our previous article, $XPRT sits at the absolute centre of the Persistence ecosystem and is positioned to derive growth of economic activity within the ecosystem. The Persistence core team will focus on building a flourishing ecosystem centred around liquid staking, through a suite of dApps designed to support innovative use-cases for stkASSETs issued by pSTAKE.

The pSTAKE protocol is currently being built on top of the Persistence Core-1 chain in a modular fashion, to support the issuance of stkASSETs on the Persistence chain. Users will deposit their native assets (such as ATOM, OSMO etc.) on the Persistence Core-1 chain (via the pSTAKE liquid staking module) to issue IBC-enabled stkASSETs against their staked assets. Issuance of stkASSETs will help to grow the total value locked (TVL) on the Persistence Core-1 chain.

In order to use these stkASSETs within the Persistence ecosystem, users will pay gas fees in the form of XPRT. stkASSETs will also be integrated with apps outside the Persistence ecosystem, using the Core-1 chain as a hub to route the flow of stkASSETs.

One of the key goals for the Persistence team throughout 2022 is bootstrapping liquidity and multiple use-cases for the stkASSETs issued through pSTAKE, ultimately making stkASSETs the core asset of the PoS economy.

Learn more about the Persistence and pSTAKE roadmap for 2022 here.

Role of $PSTAKE in the Adoption of stkASSETs

$PSTAKE is the governance and incentivization/dis-incentivization token of the pSTAKE protocol. $PSTAKE holders can participate in the protocol’s governance to contribute to its long-term success by staking $PSTAKE via the pSTAKE staking contract, securing the protocol while being incentivized to do so. Learn more about $PSTAKE here.

Additionally, $PSTAKE will be used to incentivise adoption and integrations of pSTAKE’s stkASSETs with DeFi protocols, while enabling new innovative use-cases.

Facilitating Protocol Governance

$PSTAKE will play a central role in the alignment of incentives across multiple stakeholders and securing the protocol’s infrastructure. Governance participants will be able to drive key decisions around protocol parameters, including (but not limited to):

- Governance parameters (e.g. proposal lifecycle, voting strategy, etc.)

- Protocol fee related parameters (e.g. fee categories and associated values)

- Fee distribution amongst stakeholders (e.g. XPRT stakers, validators, etc.)

- Validators parameters (e.g. validator set expansion, stake distribution, etc.)

Incentivising Innovation and Adoption

$PSTAKE token will be used to incentivise integrations and adoption of stkASSETs within multiple DeFi applications. This will be achieved through multiple initiatives:

- Inciting adoption for new use-cases for stkASSETs within the Persistence ecosystem

- Grant programs to develop support for an increasing number of PoS assets

$PSTAKE will be used to enable new innovative use-cases for stkASSETs. With these stkASSETs being hosted on the Persistence Core-1 chain, stkXPRT will become the base asset amongst the stkASSETs. The below diagram illustrates the flow of stkASSETs between the ecosystem applications that are currently live:

Parallelly, $PSTAKE token will also be used as a dis-incentivization token in case stakeholders staking $PSTAKE act maliciously or are unable to perform their respective duties appropriately.

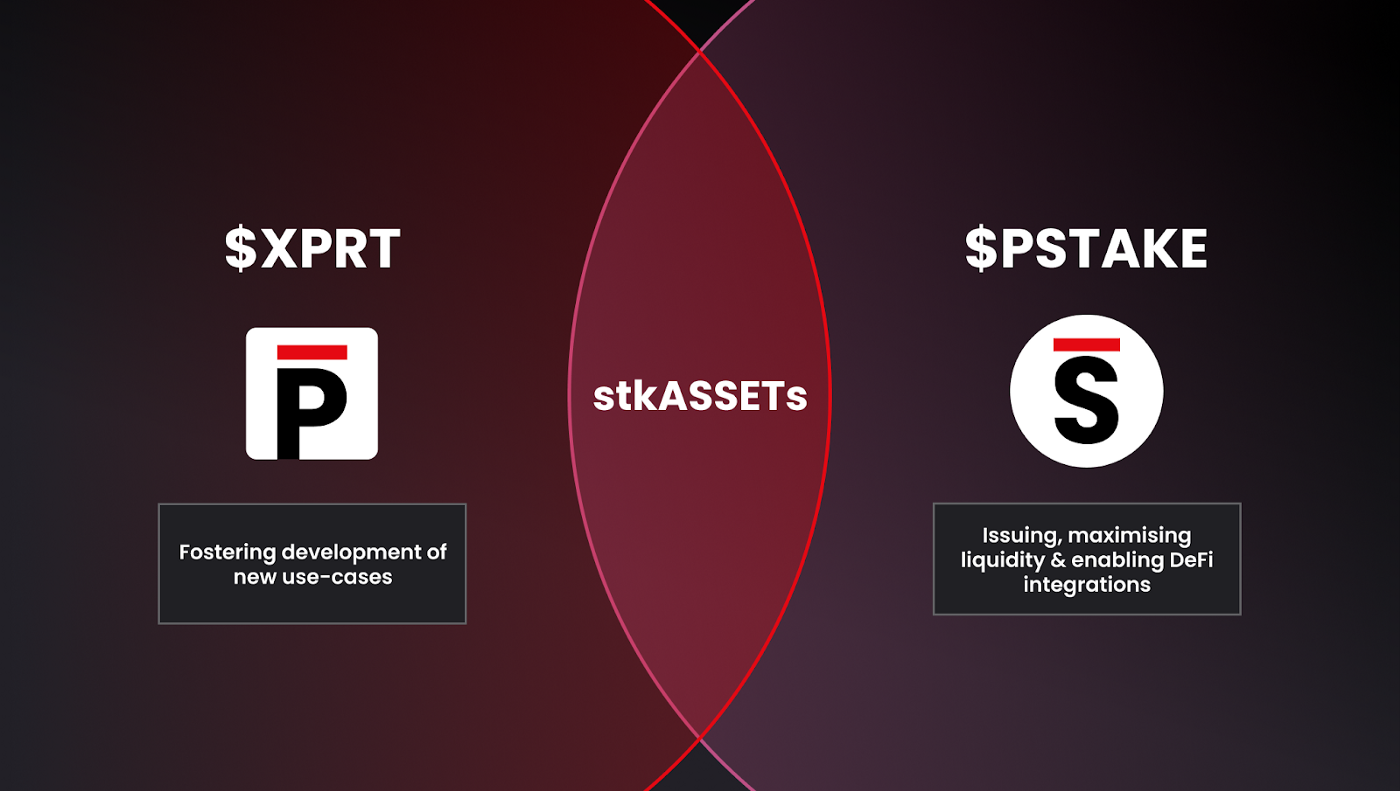

Relationship Between $XPRT and $PSTAKE

Persistence’s vision of becoming the liquid staking hub of PoS industry and making pSTAKE’s stkASSETs the go-to substitute for native assets will be realised through parallel growth on two intertwined fronts, driven by $PSTAKE and $XPRT respectively.

$PSTAKE

Role: Supporting the issuance of stkASSETs, maximising their liquidity, and enabling integrations for stkASSETs within the existing DeFi ecosystem.

$PSTAKE will be largely directed towards supporting growth at the pSTAKE protocol level by incentivising development and integrations of existing and new stkASSETs. Moreover, $PSTAKE will ensure the sustainable growth of liquidity for these stkASSETs. The expansion of DeFi opportunities for a growing number of PoS asset holders will drive demand for the issuance of stkASSETs on the Persistence Core-1 chain.

$XPRT

Role: Making stkASSETs maximally usable by fostering development of new composable use-cases.

$XPRT will support growth at the Persistence ecosystem level by encouraging the development of innovative stkASSET-focused dApps within the Persistence ecosystem. Builders will be incentivised to develop new use-cases leveraging the Persistence Core-1 chain infrastructure through any of the modular, smart-contract or app-chain approaches.

With the growth of DeFi opportunities within and outside the Persistence ecosystem, the adoption of stkASSETs will also grow through increased traction.

A Perfect Symbiosis

Essentially, $PSTAKE and $XPRT will work together to build Persistence’s vision of becoming the liquid staking hub of the PoS industry, with $PSTAKE focusing on growth at the pSTAKE protocol level and $XPRT at the Persistence ecosystem level.

With the launch of $PSTAKE token, pSTAKE and the broader Persistence ecosystem is primed to drive significant growth of the liquid staking industry in 2022 and beyond.

About Persistence

Persistence is a Tendermint-based, specialised Layer-1 network powering an ecosystem of DeFi applications focused on unlocking the liquidity of staked assets.

Persistence facilitates the issuance and deployment of liquid-staked stkASSETs, allowing users to earn staking rewards while participating in DeFi primitives, such as lending/borrowing and liquidity provisioning on DEXs.

Persistence aims to offer a seamless staking and DeFi experience for PoS (Proof-of-Stake) users and enable developers to build innovative applications around stkASSETs.

Join Our Movement

Twitter | LinkedIn | Telegram | YouTube | Reddit | [email protected]